This is an update of the fund profile originally published in December 2012. You can fined that original profile here.

Objective and Strategy

The fund seeks to maximize long-term capital growth. They invest in a global, all-cap equity portfolio which may include common and preferred stocks, convertible securities and, to a limited extent, derivatives. They’re looking for high-quality growth companies with sustainable growth characteristics. Their preference is to invest in firms that benefit from long-term growth trends and in stocks which are selling at a reasonable price. Typically they hold 60-100 stocks. No more than 30% of the portfolio may be invested in emerging markets. In general they do not hedge their currency exposure but could choose to do so if they owned a security denominated in an overvalued currency.

Adviser

Artisan Partners of Milwaukee, Wisconsin with Artisan Partners UK LLP as a subadvisor. Artisan has five autonomous investment teams that oversee twelve distinct U.S., non-U.S. and global investment strategies. Artisan has been around since 1994. As of 9/30/2012, Artisan Partners had approximately $70 billion in assets under management. That’s up from $10 billion in 2000. They advise the 12 Artisan funds, but only 5% of their assets come from retail investors.

Manager

Mark L. Yockey, Charles-Henri Hamker and Andrew J. Euretig. Mr. Yockey joined Artisan in 1995 and has been repeatedly recognized as one of the industry’s premier international stock investors. He is a portfolio manager for Artisan International, Artisan International Small Cap and Artisan Global Equity Funds. He is, Artisan notes, fluent in French. Charles-Henri Hamker is an associate portfolio manager on Artisan International Fund, and a portfolio manager with Artisan International Small Cap and Artisan Global Equity Funds. He is fluent in French and German. (Take that, Yockey.) Andrew J. Euretig joined Artisan in 2005. He is an associate portfolio manager for Artisan International Fund, and a portfolio manager for Artisan Global Equity Fund. (He never quite knows what Yockey and Hamker are whispering back and forth in French.) The team was responsible, as of 9/30/12, for about $9 billion in investments other than this fund.

Management’s Stake in the Fund

Mr. Yockey has over $1 million invested, Mr. Eurtig has between $50,000 – 100,000 and Mr. Hamker has not (yet) invested in the fund. As of December 31, 2012, the officers and directors of Artisan Funds as a group owned 17.20% of Investor Shares of the Global Equity Fund, up slightly from the year before.

Opening date

March 29, 2010

Minimum investment

$1,000, which Artisan will waive if you establish an account with an automatic investment plan.

Expense ratio

1.28% on assets of $68.4 million for Investor class shares, as of June 2023.

Comments

The argument for considering ARTHX has changed, but it has not weakened.

In mid-January 2013, lead manager Barry Dargan elected to leave Artisan. Mr. Dargan had a long, distinguished track record both here and at MFS where he managed, or co-managed, six funds, including two global funds.

With his departure, leadership for the fund shifts to Mr. Yockey has famously managed two Artisan international funds since their inception, was recognized as Morningstar’s International Fund Manager of the Year (1998) and was a finalist for the award in 2012. For most trailing time periods, his funds have top 10% returns. International Small Cap received Morningstar’s highest accolade when it was designated as the only “Gold” fund in its peer group while International was recognized as a “Silver” fund.

The change at the top offers no obvious cause for investor concern. Three factors weigh in that judgment. First, Artisan has been working consistently and successfully to move away from an “alpha manager” model toward a team-based discipline. Artisan is organized around a set of autonomous teams, each with a distinctive and definable discipline. Each team grows its own talent (that is, they’re independent of the other Artisan teams when it comes to staff and research) and grows into new funds when they have the capacity to do so. Second, the amount of experience and analytic ability on the management team remains formidable. Mr. Yockey is among the industry’s best and, like Artisan’s other lead managers, he’s clearly taken time to hire and mentor talented younger managers who move up the ladder from analyst to associate manager, co-manager and lead manager as they demonstrate they ability to meet the firm’s high standards. Artisan promises to provide additional resources, if they prove necessary, to broaden the team as their responsibilities grow. Third, Artisan has handled management transitions before. While the teams are stable, the firm has done a good job when confronted by the need to hand-off responsibilities.

The second argument on the fund’s behalf is that Artisan is a good steward. Artisan has a very good record for lowering expenses, being risk conscious, opening funds only when they believe they have the capacity to be category-leaders (and almost all are) and closing funds before they’re bloated.

Third, ARTHX is nimble. Its mandate is flexible: all sizes, all countries, any industry. The fund’s direct investment in emerging markets is limited to 30% of the portfolio, but their pursuit of the world’s best companies leads them to firms whose income streams are more diverse than would be suggested by the names of the countries where they’re headquartered. The managers note:

Though we have outsized exposure to Europe and undersized exposure to the U.S., we believe our relative country weights are of less significance since the companies we own in these developed economies continually expand their revenue bases across the globe.

Our portfolio remains centered around global industry leading companies with attractive valuations. This has led to a significant overweight position in the consumer sectors where many of our holdings benefit from significant exposure to the faster growth in emerging economies.

Since much of the world’s secular (enduring, long-term) growth is in the emerging markets, the portfolio is positioned to give them substantial exposure to it through their Europe and US-domiciled firms. While the managers are experienced in handling billions, here they’re dealing with only $25 million.

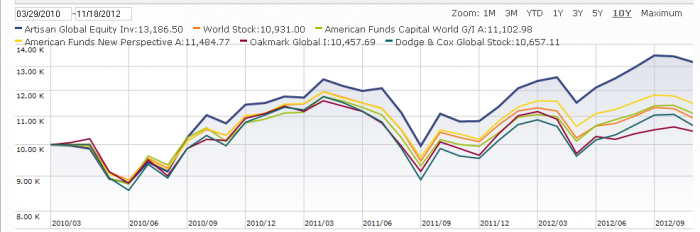

The results are not surprising. Morningstar believes that their analysts can identify those funds likely to serve their shareholders best; they do this by looking at a series of qualitative factors on top of pure performance. When they find a fund that they believe has the potential to be consistently strong in the future, they can name it as a “Gold” fund. Here are ARTHX’s returns since inception (the blue line) against all of Morningstar’s global Gold funds:

Not to say that the gap between Artisan and the other top funds is large and growing, but it is.

Bottom Line

Artisan Global Equity is an outstanding small fund for investors looking for exposure to many of the best firms from around the global. The expenses are reasonable, the investment minimum is low and the managers are first-rate. Which should be no surprise since two of the few funds keeping pace with Artisan Global Equity have names beginning with the same two words: Artisan Global Opportunities (ARTRX) and Artisan Global Value (ARTGX).

Fund website

[cr2013]