The fund: |

Matthews Asia Strategic Income (MAINX) |

|

Manager: |

Teresa Kong, Manager | |

The call: |

We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012). Highlights include:

|

|

The profile: |

The Mutual Fund Observer profile of MAINX, updated March, 2012 |

|

Web: |

Matthews Asia Strategic Income Fund Fund Focus: Resources from other trusted sources |

|

Author Archives: Editor

ASTON / River Road Long Short (ARLSX)

The fund: |

ASTON / River Road Long Short (ARLSX) |

Manager: |

Matt Moran and Dan Johnson |

The call: |

Highlights of the call: In December 2012, we spoke with Matt and Dan about the River Road Long Short Strategy, which is also used in this fund. With regard to the strategy, they noted:

|

The profile: |

The Mutual Fund Observer profile of ARLSX, dated June 2012. |

Web: |

For information about the Aston mutual fund, subadvised by River Road, please see the following: Fund Focus: Resources from other trusted sources |

RiverPark Long/Short Opportunity Fund (RLSFX)

The fund: |

RiverPark Long/Short Opportunity Fund (RLSFX) |

Manager: |

Mitch Rubin, a Managing Partner at RiverPark and their CIO. |

The call: |

For about an hour on November 29th, Mitch Rubin, manager of RiverPark Long/Short Opportunity(RLSFX) fielded questions from Observer readers about his fund’s strategy and its risk-return profile. Nearly 60 people signed up for the call. The call starts with Morty Schaja, RiverPark’s president, talking about the fund’s genesis and Mr. Rubin talking about its strategy. After that, I posed five questions of Rubin and callers chimed in with another half dozen. I’d like to especially thank Bill Fuller, Jeff Mayer and Richard Falk for the half dozen really sharp, thoughtful questions that they posed during the closing segment. Highlights of the conversation:

|

The profile: |

The Mutual Fund Observer profile of RLSFX, dated August, 2012 |

Web: |

Fund Focus: Resources from other trusted sources |

RiverPark Short Term High Yield (RPHYX)

The fund: |

RiverPark Short Term High Yield (RPHYX) |

|

Manager: |

David Sherman of Cohanzick Management, LLC | |

The call: |

For about an hour on September 13th, David Sherman of Cohanzick Management, LLC, manager of RiverPark Short Term High Yield (RPHYX) fielded questions from Observer readers about his fund’s strategy and its risk-return profile. Somewhere between 40-50 people signed up for the RiverPark call. Highlights include:

|

|

The profile: |

The Mutual Fund Observer profile of RPHYX, updated October, 2012 |

|

Web: |

Fund Focus: Resources from other trusted sources |

|

New and Noteworthy Site

LearnBonds Mutual Fund & ETF Ratings

History and Focus

LearnBonds (LB) Mutual Fund & ETF Ratings was launched in December 2011 by its co-founders Marc Prosser and David Waring. Marc Prosser is currently a Forbes contributor; previously he was the Chief Marketing Officer at Forex Capital Markets (FXCM). David Waring was formerly the Managing Director, business development and strategy, at Market Simplified Inc.

Unlike industry heavyweights such as Morningstar and Lipper, LB Ratings focuses on a relatively small number of bond funds in a limited number of categories. They divide funds into categories based on purpose. The categories currently listed are core bond funds, municipal bond funds, short term/low-duration bond funds, high credit risk bond funds and long duration funds. Their belief is that no individual or family should have more than 5 purpose driven funds in their portfolio. This is how David Waring describes their approach:

We have tremendous respect for Morningstar and Lipper’s mutual fund and ETF ratings. LB Ratings will not replace these great tools. However, we recognize many investors find these tools overwhelming and complicated to apply to making investment choices. We are addressing the need for a simplified product which expresses strong views as to which funds an investor should own.

Methodology

LB Ratings does not use a mathematical formula to identify or rate individual funds. Every fund listed on LB ratings was personally chosen and rated by the co-founders. Instead of mechanical, number-based, quantitative analysis, they use a specific set of criteria to personally select and rate individual funds. Factors include fund performance both long and short term, risk levels, associated fees and quality and tenure of management. Funds are given a rating level between 1 and 5 stars, 1 being the lowest and 5 the highest. The website describes this method as “opinionated ratings.” They are clear and upfront about their methods and their belief that all fund rating agencies and websites are inherently subjective. This makes LB’s ratings akin to Morningstar’s Analyst Ratings (the Gold, Silver … designations).

Extras

Every fund listed is accompanied by a compact but comprehensive report that outlines its strengths and weaknesses, as well as the rationale behind its rating. In addition to their bond fund and ETF lists, LB Ratings also offers links to bond and fund related articles. Additionally, website visitors can sign up for a daily newsletter, or download the free e-book “How to Invest in Bonds.”

Pros

The website is simple and straightforward, providing shortlists of funds that were hand chosen by experts in the field. The rating report that accompanies each fund is clear and concise, giving readers information that can be useful to them independent of the rating. Fewer categories and shorter lists may be less stressful to some investors and help to reduce confusion.

Cons

The limited number of categories and funds means that inevitably many strong candidates will be missing. The subjective nature of the ratings will be too abstract for many. The lack of comparative tools – and tools in general – will limit the site’s appeal to investors who need more in-depth coverage. One practical concern we have is that there’s no evidence of predictive validity for the LB ratings; that is, they don’t have proof that their five star funds will perform better in the future than their three star ones. Here’s Mr. Prosser’s response:

As far as predictive analysis , I would make the argument that at least for actively traded bonds funds we are in a period of time where quantitative analysis is difficult to employ:

Funds have radically changed the profile of the assets they hold and significantly drifted away from their benchmarks. Here are two easy examples; the Templeton World Bond Fund is now a short-duration fund, with a duration two years shorter than its peers. The PIMCO Total Return Fund now is a large holder of munis. which are neither included in its benchmark nor have they ever been a major part of its holdings. In both cases, these are radical departures from the past . . . and at the same time [might be] temporary positions . . . As a result, more than ever you’re “betting” on the skill of the fund’s manager. Or put another way, historically the best performing bond mutual funds had most their returns generated from beta and now they are generating it from alpha. In short, I don’t think the quant models being employed really capture this shift. [Assessing these funds] requires more qualitative analysis.

Bottom Line

Although the website’s offerings are limited, many investors may prefer a human chosen shortlist of choices over one generated by a computer. For those who don’t need or likely will not use tools such as screeners and comparative charts, the simple straightforward nature of LB Ratings will be welcome. As the website itself acknowledges though, a fund rating website is built on trust. Trust is earned over time, and ultimately only time will tell how the “opinionated ratings” approach fares against the tried and tested methods of the industry’s heavyweights in terms of performance. For now, we conclude that LB has a sensible niche, that it’s interesting, worth watching and potentially useful, so long as you use their ratings as a starting point rather than a final word.

Website

May 1, 2012, A brief note

Dear Gentle Reader,

There will be a slight delay in publishing the May 2012 issue of the Observer. In the past 24 hours I’ve been laid low by a particularly unattractive virus. While our monthly essay is pretty much done, I haven’t been able to complete the final pre-publication quality review. With luck (and a lot of medicine), we’re hopeful of having the May issue available on the evening of May 1st.

Highlights of some of the stories we’re pursuing this month include:

The Greatest Fund that Isn’t. As of mid-April 2012, data services reported one fund with 180% year-to-date returns. It turns out to be an old and occasionally troubled friend that’s not quite a fund any longer.

The Return of the Giants, a review of the cheerful notion that the “star managers” have regained their footing in 2012.

“A Giant Sucking Sound” and Investor Interest in Mutual Funds. We’ve updated our link to Google’s analysis of interest in mutual funds and the picture isn’t getting brighter. We suspect that fund companies, in too many instances, abet the decline through insensitive, desultory communications with their shareholders, so we talk about really good shareholder communication and a new service designed to help smaller fund companies get better.

The Best of the Web: Curated News Aggregators. Google News manages to draw 100,000 clicks a minute with its collection of mechanically assembled and arranged content. News aggregators offer a useful service, and it’s possible for you to do a lot better than robo-edited content. Junior highlights two first rate, human curated aggregators (Abnormal Returns and Counterparties).

As always, we offered new or updated profiles of four cool funds (Amana Developing World, Artisan Global Value, FMI International and LKCM Balanced).

There’s important news from a half dozen fund companies, including a new fund in registration that represents a collaboration of two fine firms, RiverNorth and Manning & Napier.

Except for our monthly highlights and commentary, all of the new content is available now using the navigation tabs along the top of this page.

Thanks for your patience and regrets for the delay,

Bretton Fund (BRTNX) – February 2012

Objective and Strategy

The Bretton Fund seeks to achieve long-term capital appreciation by investing in a small number of undervalued securities. The fund invests in common stocks of companies of all sizes. It normally holds a core position of between 15 to 20 securities whose underlying firms combine a defensible competitive advantage, relevant products, competent and shareholder-oriented management, growth, and a low level of debt. The manager wants to invest “in ethical businesses” but does not use any ESG screens; mostly he avoids tobacco and gaming companies.

Adviser

Bretton Capital Management, LLC. Bretton was founded in 2010 to advise this fund, which is its only client.

Manager

Stephen Dodson. From 2002 to 2008, Mr. Dodson worked at Parnassus Investments in San Francisco, California, where he held various positions including president, chief operating officer, chief compliance officer and was a co-portfolio manager of a $25 million California tax-exempt bond fund. Prior to joining Parnassus Investments, Mr. Dodson was a venture capital associate with Advent International and an investment banking analyst at Morgan Stanley. Mr. Dodson attended the University of California, Berkeley, and earned a B.S. in Business Administration from the Haas School of Business.

Management’s Stake in the Fund

Mr. Dodson has over a million dollars invested in the fund. As of April 5, 2011, Mr. Dodson and his family owned about 75% of the fund’s shares.

Opening date

September 30, 2010.

Minimum investment

$5000 for regular accounts, $1000 for IRAs or accounts established with an automatic investment plan. The fund’s available for purchase through E*Trade and Pershing.

Expense ratio

1.5% on $3 million in assets.

Comments

Mr. Dodson is an experienced investment professional, pursuing a simple discipline. He wants to buy deeply discounted stocks, but not a lot of them. Where some funds tout a “best ideas” focus and then own dozens of the same large cap stocks, Bretton seems to mean it when he says “just my best.”

As of 9/30/11, the fund held just 15 stocks. Of those, six were large caps, three mid-caps and six small- to micro-cap. His micro-cap picks, where he often discerns the greatest degree of mispricing, are particularly striking. Bretton is one of only a handful of funds that owns the smaller cap names and it generally commits ten or twenty times as much of the fund’s assets to them.

In addition to being agnostic about size, the fund is also unconstrained by style or sector. Half of the fund’s holdings are characterized as “growth” stocks, half are not. The fund offers no exposure at all in seven of Morningstar’s 11 industry sectors, but is over weighted by 4:1 in financials.

This is the essence of active management, and active management is about the only way to distinguish yourself from an overpriced index. Bretton’s degree of concentration is not quite unprecedented, but it is remarkable. Only six other funds invest with comparable confidence (that is, invests in such a compact portfolio), and five of them are unattractive options.

Biondo Focus (BFONX) holds 15 stocks and (as of January 2012) is using leverage to gain market exposure of 130%. It sports a 3.1% e.r. A $10,000 investment in the fund on the day it launched was worth $7800 at the end of 2011, while an investment in its average peer for the same period would have grown to $10,800.

Huntington Technical Opportunities (HTOAX) holds 12 stocks (briefly: it has a 440% portfolio turnover), 40% cash, and 10% S&P index fund. The expense ratio is about 2%, which is coupled with a 4.75% load. From inception, $10,000 became $7200 while its average peer would be at $9500.

Midas Magic (MISEX). The former Midas Special Fund became Midas Magic on 4/29/2011. Dear lord. The ticker reads “My Sex” and the name cries out for Clara Peller to squawk “Where’s The Magic?” The fund reports 0% turnover but found cause to charge 3.84% in expenses anyway. Let’s see: since inception (1986), the fund has vastly underperformed the S&P500, its large cap peer group, short-term bond funds, gold, munis, currency . . . It has done better than the Chicago Cubs, but that’s about it. It holds 12 stocks.

Monteagle Informed Investor Growth (MIIFX) holds 12 stocks (very briefly: it reports a 750% turnover ratio) and 20% cash. The annual report’s lofty rhetoric (“The Fund’s goal is to invest in these common stocks with demonstrated informed investor interest and ownership, as well as, solid earnings fundamentals”) is undercut by an average holding period of six weeks. The fund had one brilliant month, November 2008, when it soared 36% as the market lost 10%. Since then, it’s been wildly inconsistent.

Rochdale Large Growth (RIMGX) holds 15 stocks and 40% cash. From launch through the end of 2011, it turned $10,000 to $6300 while its large cap peer group went to $10,600.

The Cook & Bynum Fund (COBYX) is the most interesting of the lot. It holds 10 stocks (two of which are Sears and Sears Canada) and 30% cash. Since inception it has pretty much matched the returns of a large-value peer group, but has done so with far lower volatility.

And so fans of really focused investing have two plausible candidates, COBYX and BRTNX. Of the two, Bretton has a far more impressive, though shorter, record. From inception through the end of 2011, $10,000 invested in Bretton would have grown to $11,500. Its peer group would have produced an average return of $10,900. For 2011 as a whole, BRTNX’s returns were in the top 2% of its peer group, by Morningstar’s calculus. Lipper, which classifies it as “multi-cap value,” reports that it had the fourth best record of any comparable fund in 2011. In particular, the fund outperformed its peers in every month when the market was declining. That’s a particularly striking accomplishment given the fund’s concentration and micro-cap exposure.

Bottom Line

Bretton has the courage of its convictions. Those convictions are grounded in an intelligent reading of the investment literature and backed by a huge financial commitment by the manager and his family. It’s a fascinating vehicle and deserves careful attention.

Fund website

[cr2012]

Marathon Value (MVPFX), August 2011

*On December 12, 2022, Green Owl Intrinsic Value Fund (GOWLX) and Marathon Value Portfolio (MVPFX) were merged and converted into a new Kovitz Core Equity ETF (EQTY) along with over $500 million of assets from separately managed accounts. The ETF adopted the record and strategy of the Green Owl Fund. In consequence, the information for Marathon Value should be read for archival purposes only.*

Objective

To provide shareholders with long-term capital appreciation in a well-diversified portfolio. They invest primarily in U.S. mid- to large caps, though the portfolio does offer some international exposure (about 10% in mid-2011) and some small company exposure (about 2%). On average, 80% of the portfolio is in the stock market while the rest is in cash, short term bonds and other cash equivalents. The manager looks to buy stocks that are “relatively undervalued,” though Morningstar generally describes the portfolio as a blend of styles. The core of the portfolio is in “sound businesses [with] dedicated, talented leaders” though they “sometimes may invest opportunistically in companies that may lack one of these qualities.” The portfolio contains about 80 stocks and turnover averages 30% per year.

Adviser

Spectrum Advisory Services, an Atlanta based investment counseling firm whose clients include high net worth individuals and pension and profit sharing plans. In addition to advising this fund, Spectrum manages over $415 million in taxable, retirement and charitable accounts for high net worth individuals and institutions.

Manager

Marc S. Heilweil. Mr. Heilweil is President of Spectrum. He founded the firm in 1991 and has managed Marathon since early 2000. He received both his B.A. and his J.D. from Yale.

Management’s Stake in the Fund

Mr. Heilweil has over $1 million invested, and is the fund’s largest shareholder.

Opening date

The original fund launched on March 12, 1998 but was reorganized and re-launched under new management in March 2000.

Minimum investment

$2,500 across the board.

Expense ratio

1.23% on assets of $41 million (as of 6/30/2011). Update – 1.25% on assets of nearly $42 million (as of 1/15/2012.)

Comments

It’s not hard to find funds with great returns. Morningstar lists them daily, the few surviving financial magazines list them monthly and The Wall Street Journal lists them quarterly. It’s considerably harder to find funds that will make a lot of money for you. The indisputable reality is that investors get greedy any time that the market hasn’t crashed in 12 months and are delusional about their ability to stick with a high-return investment. Many funds with spectacular absolute returns have earned very little for their investors because the average investor shows up late (after the splendid three-year returns have been publicized) and leaves early (after the inevitable overshoot on the downside).

The challenge is to figure out what your portfolio needs to look like (that is, your mix of stocks, bonds and cash and how much you need to be adding) in order for you to have a good chance of achieving your goals, and then pick funds that will give you exposure to those assets without also giving you vertigo.

For investors who need core stock exposure, little-known Marathon Value offers a great vehicle to attempt to get there safely and in comfort. The manager’s discipline is unremarkable. He establishes a firm’s value by looking at management strength (determined by long-term success and the assessment of industry insiders) and fundamental profitability (based on a firm’s enduring competitive advantages, sometimes called its “economic moat”). If a firm’s value exceeds, “by a material amount,” its current share price, the manager will look to buy. He’ll generally buy common stock, but has the option to invest in a firm’s high-yield bonds (up to 10% of the portfolio) or preferred shares if those offer better value. Occasionally he’ll buy a weaker firm whose share price is utterly irrational.

The fund’s April 2011 semi-annual report gives a sense of how the manager thinks about the stocks in his portfolio:

In addition to Campbell, we added substantially to our holdings of Colgate Palmolive in the period. Concerns about profit margins drove it to a price where we felt risk was minimal. In the S&P 500, Colgate has the second highest percentage of its revenues overseas. Colgate also is a highly profitable company with everyday products. Colgate is insulated from private label competition, which makes up just 1% of the toothpaste market. Together with Procter & Gamble and Glaxo Smithkline, our fund owns companies which sell over half the world’s toothpaste. While we expect these consumer staples shares to increase in value, their defensive nature could also help the fund outperform in a down market.

Our holdings in the financial sector consist of what we consider the most careful insurance underwriters, Alleghany Corp., Berkshire Hathaway and White Mountain Insurance Group. All three manage their investments with a value bias. While Berkshire was purchased in the fund’s first year, we have not added to the position in the last five years. One of our financials, U.S. Bancorp (+7%) is considered the most conservatively managed of the nation’s five largest banks. The rest of our financial holdings are a mix of special situations.

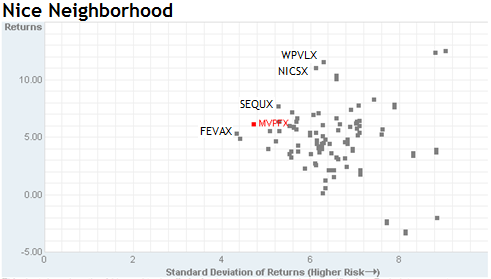

There seems nothing special about the process, but the results place Marathon among the industry’s elite. Remember: the goal isn’t sheer returns but strong returns with limited risk. Based on those criteria, Marathon is about as good as a stock fund gets. For “visual learners,” it’s useful to glance at a risk-return snapshot of domestic equity funds over the past three years.

Here’s how to read the chart: you want to be as close as possible to the upper-left corner (infinite returns, zero risk). The closer you get, the better you’re being served by your manager. Five funds define a line of ideal risk/return balance; those are the five dots in a row near the upper-left. Who are they? From lower return/lower risk, they are:

First Eagle US Value (FEVAX): five stars, $1.8 billion in assets, made famous by Jean-Marie Eveillard.

Marathon Value (MVPFX): five stars for the past three-, five- and ten-year periods, as well as since inception, but with exceedingly modest assets.

Sequoia (SEQUX): five stars, $4.4 billion in assets, made famous by Bill Ruane and Bob Goldfarb, closed to new investors for a quarter century.

Nicholas (NICSX): five stars for the past three years, $1.7 billion, low turnover, willing to hold cash, exceedingly cautious, with the same manager (Ab Nicholas) for 41 years.

Weitz Partners Value (WPVLX): five stars over the past three years, $710 million in assets, run by Wally Weitz for 28 years.

That’s a nice neighborhood, and the funds have striking similarities: a commitment to high quality investments, long-tenured managers, low turnover, and a willingness to hold cash when circumstances dictate. Except for Marathon, they average $2 billion in assets.

Fans of data could search Morningstar’s database for domestic large cap stock funds that, like Marathon, have “low risk” but consistently better long-term returns than Marathon. There are exactly three funds (of about 1300 possibles) that meet those criteria: the legendary Sequoia, Amana Income (AMANX) and Auxier Focus (AUXFX), both of which are also profiled as “stars in the shadows.”

Regardless of how you ask the question, you seem to get the same answer: over Mr. Heilweil’s decade with the fund, it has consistently taken on a fraction of the market’s volatility (its beta value is between 74 and 76 over the past 3 – 10 years and Morningstar calculates its “downside capture ratio” as 68%). Alan Conner from Spectrum reports that Marathon is the 11th least volatile large core fund of near 1800 that Morningstar tracks. At the same time, it produces decent if not spectacular returns in rising markets (it captures about 82% of the gains in a rising market). That combination lets it post returns in the top 10% of its peer group over the past 3 – 10 years.

Because Mr. Heilweil is in his mid 60s and the fund depends on his skills, potential investors might reasonably ask about his future. Mr. Conner says that Heilweil intends to be managing the fund a decade from now. The fund represents a limited piece of Heilweil’s workload, which decreases the risk that he’ll become bored or discouraged with it.

Bottom Line

If you accept the arguments that (a) market volatility will remain a serious concern and (b) high-quality firms remain the one undervalued corner of the market, then a fund with a long record of managing risk and investing in high-quality firms makes great sense. Among funds that fit that description, few have compiled a stronger record than Marathon Value.

Fund website

Marathon Value Portfolio, though the website has limited and often outdated content.

© Mutual Fund Observer, 2011. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact David@MutualFundObserver.com.

Tocqueville Select Fund (TSELX), January 2012

*The fund has been liquidated.*

Objective and Strategy

Tocqueville Select Fund pursues long-term capital appreciation by investing in a focused group of primarily small and mid-sized U.S. stocks. The portfolio, as of 9/30/11, is at the high end of its target of 12 to 25 stocks. The managers pursue a bottom-up value approach, with special delight in “special situations” (that is, companies left for dead by other investors). The fund can hedge its market exposure, but cannot short. It can invest in fixed-income instruments, but seems mostly to hold stocks and cash. Cash holdings are substantial, often 10 – 30% of the portfolio.

Adviser

Tocqueville Asset Management, which “has been managing private fortunes for more than 30 years.” They serve as advisor to six Tocqueville funds, including the two former Delafield funds. The Advisor has been in the public asset management business since 1990 and. as of January, 2011, had more than $10.8 billion in assets under management.

Managers

J. Dennis Delafield, Vincent Sellecchia, and Donald Wang. Mr. Delafield founded Delafield Asset Management in 1980 which became affiliated with Reich & Tang Asset Management in 1991. He and his team joined Tocqueville in 2009. Mr. Sellecchia worked with Delafield at Reich & Tang and Delafield. He and Delafield have co-managed The Delafield Fund since 1993. Mr. Wang seems to be the junior partner (though likely a talented one), having served as an analyst on The Delafield Fund and with Lindner funds. Mr. Sellechia was the first manager (1998) of the partnership on which this fund is based, Mr. Wang came on board in 2003 and Mr. Delafield in 2005.

Management’s Stake in the Fund

Messrs Delafield and Sellecchia have each invested between $100,000 – 500,000 in Select and over $1 million in Delafield. As of last report, Mr. Wang hadn’t joined the party. Half of the fund’s trustees (4 of 8) have investments in the fund.

Opening date

Good question! Select is the mutual fund successor to a private partnership, the Reich & Tang Concentrated Portfolio L.P. The partnership opened on July 31, 1998. On September 28 2008, it became Delafield Select Fund (a series of Natixis Funds Trust II) and one year later, it became The Select Fund (a series of The Tocqueville Trust). This is to say, it’s a 13-year-old portfolio with a three-year record.

Minimum investment

$1000 for regular accounts, $250 for IRAs

Expense ratio

1.4% on $102 million in assets. Assets jumped from $60 million to $100 million in the months after Morningstar, in September 2011, released its first rating for the fund. There’s also a 2% redemption fee on shares held under 120 days.

Comments

Have you ever thought about how cool it would be if Will Danoff ran a small fund again, rather than the hauling around $80 billion in Contrafund assets? Or if Joel Tillinghast were freed of the $33 billion that Low-Priced Stock carries? In short, if you had a brilliant manager suddenly free to do bold things with manageable piles of cash? If so, you grasp the argument for The Select Fund.

Tocqueville Select Fund is the down-sized, ramped-up version of The Delafield Fund (DEFIX). The two funds have the same management team, the same discipline and portfolios with many similarities. Both have very large cash stakes, about the same distribution of stocks by size and valuation, about the same international exposure, and so on. Both value firms with good management teams and lots of free cash flow, but both make their money off “financially troubled” firms. The difference is that Select is (1) smaller, (2) more concentrated and (3) a bit more aggressive.

All of which is a very good thing for modestly aggressive equity investors. Delafield is a great fund, which garners only a tiny fraction of the interest it warrants. Morningstar analysis Michael Breen, in September 2010, compared Delafield to the best mid-cap value funds (Artisan, Perkins, Vanguard) and concluded that Delafield was decisively better.

Its 11.4% annual gain for the past decade is the best in its category by a wide margin, and its 15-year return is nearly as good. And a look at upside and downside capture ratios shows this fund is the only one in the group that greatly outperformed the Russell Mid Cap Value Index in up and down periods the past 10 years.

Delafield Select was ever better. Over the ten years ending 12/29/2011, the Select Portfolio would have turned $10,000 into $27,800 returned 14.5% while an investment in its benchmark, the Russell 2000, would have grown to $17,200. Note that 70% of that performance occurred as a limited partnership, though the partnership’s fees were adjusted to make the performance comparable to what Select might have charged over that period.

That strong performance, however, has continued since the fund’s launch. $10,000 invested at the fund’s inception would now be worth $13,200; the benchmark return for the same period would be $11,100.

The fund has also substantially outperformed its $1.3 billion sibling Delafield Fund, both from the inception of the partnership and from inception of the mutual fund.

The red flag is volatility. The fund has four distinctive characteristics which would make it challenging as a significant portion of your portfolio:

- It’s very concentrated for a small cap fund, it might hold as few as a dozen stocks and even its high end (25-30 stocks) is very, very low.

- It looks for companies which are in trouble but which the managers believe will right themselves.

- It invests a lot in microcap stocks: about 30% at its last portfolio report.

- It invests a lot in a few sectors: the portfolio is constructed company by company, so it’s possible for some sectors (materials, as of late 2011) to be overweighted by 600% while there’s no exposure at all to another six half sectors.

It’s not surprising that the fund is volatile: Morningstar ranks is as “above average” in risk. What is surprising is that it’s not more volatile; by Morningstar’s measurement, its “downside capture” has been comparable to its average small-value peer while its upside has been substantially greater.

Bottom Line

This is not the only instance where a star manager converted a successful partnership into a mutual fund, and the process has not always been successful. Baron Partners (BPTRX) started life as a private partnership and as the ramped-up version of Baron Growth (BGRFX), but has decisively trailed its milder sibling since its launch as a fund. That said, the Delafield team seem to have successfully managed the transition and interest in the fund bounced in September 2011, when it earned its first Morningstar rating. Investors drawn by the prospects of seeing what Delafield and company can do with a bit more freedom and only 5% of the assets might find this a compelling choice for a small slice of a diversified portfolio.

Fund website

[cr2012]

Northern Global Tactical Asset Allocation Fund (BBALX) – September 2011, Updated September 2012

This profile has been updated since it was originally published. The updated profile can be found at http://www.mutualfundobserver.com/2012/09/northern-global-tactical-asset-allocation-fund-bbalx-september-2011-updated-september-2012/

Objective

The fund seeks a combination of growth and income. Northern’s Investment Policy Committee develops tactical asset allocation recommendations based on economic factors such as GDP and inflation; fixed-income market factors such as sovereign yields, credit spreads and currency trends; and stock market factors such as domestic and foreign earnings growth and valuations. The managers execute that allocation by investing in other Northern funds and outside ETFs. As of 6/30/2011, the fund holds 10 Northern funds and 3 ETFs.

Adviser

Northern Trust Investments. Northern’s parent was founded in 1889 and provides investment management, asset and fund administration, fiduciary and banking solutions for corporations, institutions and affluent individuals worldwide. As of June 30, 2011, Northern Trust Corporation had $97 billion in banking assets, $4.4 trillion in assets under custody and $680 billion in assets under management. The Northern funds account for about $37 billion in assets. When these folks say, “affluent individuals,” they really mean it. Access to Northern Institutional Funds is limited to retirement plans with at least $30 million in assets, corporations and similar institutions, and “personal financial services clients having at least $500 million in total assets at Northern Trust.” Yikes. There are 51 Northern funds, seven sub-advised by multiple institutional managers.

Managers

Peter Flood and Daniel Phillips. Mr. Flood has been managing the fund since April, 2008. He is the head of Northern’s Fixed Income Risk Management and Fixed Income Strategy teams and has been with Northern since 1979. Mr. Phillips joined Northern in 2005 and became co-manager in April, 2011. He’s one of Northern’s lead asset-allocation specialists.

Management’s Stake in the Fund

None, zero, zip. The research is pretty clear, that substantial manager ownership of a fund is associated with more prudent risk taking and modestly higher returns. I checked 15 Northern managers listed in the 2010 Statement of Additional Information. Not a single manager had a single dollar invested. For both practical and symbolic reasons, that strikes me as regrettable.

Opening date

Northern Institutional Balanced, this fund’s initial incarnation, launched on July 1, 1993. On April 1, 2008, this became an institutional fund of funds with a new name, manager and mission and offered four share classes. On August 1, 2011, all four share classes were combined into a single no-load retail fund but is otherwise identical to its institutional predecessor.

Minimum investment

$2500, reduced to $500 for IRAs and $250 for accounts with an automatic investing plan.

Expense ratio

0.68%, after waivers, on assets of $18 million. While there’s no guarantee that the waiver will be renewed next year, Peter Jacob, a vice president for Northern Trust Global Investments, says that the board has never failed to renew a requested waiver. Since the new fund inherited the original fund’s shareholders, Northern and the board concluded that they could not in good conscience impose a fee increase on those folks. That decision that benefits all investors in the fund. Update – 0.68%, after waivers, on assets of nearly $28 million (as of 12/31/2012.)

| UpdateOur original analysis, posted September, 2011, appears just below this update. Depending on your familiarity with the research on behavioral finance, you might choose to read or review that analysis first. | September, 2012 | ||||||||||||||||||||

| 2011 returns: -0.01%. Depending on which peer group you choose, that’s either a bit better (in the case of “moderate allocation” funds) or vastly better (in the case of “world allocation” funds). 2012 returns, through 8/29: 8.9%, top half of moderate allocation fund group and much better than world allocation funds. | |||||||||||||||||||||

| Asset growth: about $25 million in twelve months, from $18 – $45 million. | |||||||||||||||||||||

This is a rare instance in which a close reading of a fund’s numbers are as likely to deceive as to inform. As our original commentary notes:The fund’s mandate changed in April 2008, from a traditional stock/bond hybrid to a far more eclectic, flexible portfolio. As a result, performance numbers prior to early 2008 are misleading.The fund’s Morningstar peer arguably should have changed as well (possibly to world allocation) but did not. As a result, relative performance numbers are suspect.The fund’s strategic allocation includes US and international stocks (including international small caps and emerging markets), US bonds (including high yield and TIPs), gold, natural resources stocks, global real estate and cash. Tactical allocation moves so far in 2012 include shifting 2% from investment grade to global real estate and 2% from investment grade to high-yield.Since its conversion, BBALX has had lower volatility by a variety of measures than either the world allocation or moderate allocation peer groups or than its closest counterpart, Vanguard’s $14 billion STAR (VGSTX) fund-of-funds. It has, at the same time, produced strong absolute returns. Here’s the comparison between $10,000 invested in BBALX at conversion versus the same amount on the same day in a number of benchmarks and first-rate balanced funds:

BBALX holds a lot more international exposure, both developed and developing, than its peers. Its record of strong returns and muted volatility in the face of instability in many non-U.S. markets is very impressive. BBALX has developed in a very strong alternative to Vanguard STAR (VGSTX). If its greater exposure to hard assets and emerging markets pays off, it has the potential to be stronger still. |

|||||||||||||||||||||

Comments

The case for this fund can be summarized easily. It was a perfectly respectable institutional balanced fund which has become dramatically better as a result of two sets of recent changes.

Northern Institutional Balanced invested conservatively and conventionally. It held about two-thirds in stocks (mostly mid- to large-sized US companies plus a few large foreign firms) and one-third in bonds (mostly investment grade domestic bonds). Northern’s ethos is very risk sensitive which makes a world of sense given their traditional client base: the exceedingly affluent. Those folks didn’t need Northern to make a ton of money for them (they already had that), they needed Northern to steward it carefully and not take silly risks. Even today, Northern trumpets “active risk management and well-defined buy-sell criteria” and celebrates their ability to provide clients with “peace of mind.” Northern continues to highlight “A conservative investment approach . . . strength and stability . . . disciplined, risk-managed investment . . . “

As a reflection of that, Balanced tended to capture only 65-85% of its benchmark’s gains in years when the market was rising but much less of the loss when the market was falling. In the long-term, the fund returned about 85% of its 65% stock – 35% bond benchmark’s gains but did so with low volatility.

That was perfectly respectable.

Since then, two sets of changes have made it dramatically better. In April 2008, the fund morphed from conservative balanced to a global tactical fund of funds. At a swoop, the fund underwent a series of useful changes.

The asset allocation became fluid, with an investment committee able to substantially shift asset class exposure as opportunities changed.

The basic asset allocation became more aggressive, with the addition of a high-yield bond fund and emerging markets equities.

The fund added exposure to alternative investments, including gold, commodities, global real estate and currencies.

Those changes resulted in a markedly stronger performer. In the three years since the change, the fund has handily outperformed both its Morningstar benchmark and its peer group. Its returns place it in the top 7% of balanced funds in the past three years (through 8/25/11). Morningstar has awarded it five stars for the past three years, even as the fund maintained its “low risk” rating. Over the same period, it’s been designated a Lipper Leader (5 out of 5 score) for Total Returns and Expenses, and 4 out of 5 for Consistency and Capital Preservation.

In the same period (04/01/2008 – 08/26/2011), it has outperformed its peer group and a host of first-rate balanced funds including Vanguard STAR (VGSTX), Vanguard Balanced Index (VBINX), Fidelity Global Balanced (FGBLX), Leuthold Core (LCORX), T. Rowe Price Balanced (RPBAX) and Dodge & Cox Balanced (DODBX).

In August 2011, the fund morphed again from an institutional fund to a retail one. The investment minimum dropped from $5,000,000 to as low as $250. The expense ratio, however, remained extremely low, thanks to an ongoing expense waiver from Northern. The average for other retail funds advertising themselves as “tactical asset” or “tactical allocation” funds is about 1.80%.

Bottom Line

Northern GTA offers an intriguing opportunity for conservative investors. This remains a cautious fund, but one which offers exposure to a diverse array of asset classes and a price unavailable in other retail offerings. It has used its newfound flexibility and low expenses to outperform some very distinguished competition. Folks looking for an interesting and affordable core fund owe it to themselves to add this one to their short-list.

Fund website

Northern Global Tactical Asset Allocation

Update – 3Q2011 Fact Sheet

Fund Profile, 2nd quarter, 2012

[cr2012]