Objective

The fund seeks long-term capital appreciation and income, while trying to maintain a sense of “prudent investment risk over the long-term.” RNCOX is a “balanced” fund with several twists. First, it adjusts its long-term asset allocation in order to take advantage of tactical allocation opportunities. Second, it invests primarily in a mix of closed-end mutual funds and ETFs.

Adviser

RiverNorth Capital, which was founded in 2000. RiverNorth manages about $700 million in assets, including two funds, a limited partnership and a number of separate accounts.

Managers

Patrick Galley and Stephen O’Neill. Mr. Galley is the chief investment officer for RiverNorth Capital. Before that, he was a Vice President at Bank of America in the Portfolio Management group. Mr. O’Neill is “the Portfolio Manager for RiverNorth Capital,” and also an alumnus of Bank of America. Messrs Galley and O’Neill also manage part of one other fund (RiverNorth/DoubleLine Strategic Income, RNSIX), one hedge fund and 700 separate accounts, valued at $150 million. Many of those accounts are only nominally “separate” since the retirement plan for a firm’s 100 employees might be structured in such a way that it needs to be reported as 100 separate accounts. Galley and O’Neill are assisted by a quantitative analyst whose firm specializes in closed-end fund trading strategies.

Management’s Stake in the Fund

Mr. Galley and Mr. O’Neill each has invested between $100,000 – $500,000 in the fund, as of the January, 2011 Statement of Additional Information. In addition, Mr. Galley founded and owns more than 25% of RiverNorth.

Opening date

December 27, 2006.

Minimum investment

$5,000 for regular accounts and $1,000 for retirement accounts.

This fund is closing at the end of June 2011.

Expense ratio

2.39% after minimal expense deferrals.

Comments

The argument in favor of RNCOX is not just its great performance. It does have top flight performance credentials:

- five-star rating from Morningstar, as of June 2011

- a Lipper Leader for total and consistent returns, also as of June 2011

- annualized return of 9.2% since inception, compared to 0.6% for the S&P 500

- above average returns in every calendar year of its existence

- top 2% returns since inception

and so on. All of that is nice, but not quite central.

The central argument is that RNCOX has a reason to exist, a claim that lamentably few mutual funds can seriously make. RNCOX offers investors access to a strategy which makes sense and which is not available through – so far as I can tell – any other publicly accessible investment vehicle.

To understand that strategy, you need to understand the basics of closed-end funds (CEFs). CEFs are a century-old investment vehicle, older by decades that conventional open-end mutual funds. The easiest way to think of them is as actively-managed ETFs: they are funds which can be bought or sold throughout the day, just like stocks or ETFs. Each CEF carries two prices. Its net asset value is the pro-rated value of the securities in its portfolio. Its market price is the amount buyers are willing to pay to obtain one share of the CEF. In a rational, efficient market, the NAV and the market price would be the same. That is, if one share of a CEF contained $100 worth of stock (the NAV), then one share of the fund would sell for $100 (the market price). But they don’t.

Why not? Because investors are prone to act irrationally. They panic and sell stuff for far less than its worth. They get greedy and wildly overpay for stuff. Because the CEF market is relatively small – 644 funds and $183 billion in assets (Investment Company Institute data, 5/27/2009) – panicked or greedy reactions by a relatively small number of investors can cause shares of a CEF to sell at a huge discount (or premium) to the actual value of the securities that the fund sells. By way of example, shares of Charles Royce’s Royce Micro-cap Trust (RMT) are selling at a 16% discount to the fund’s NAV; if you bought a share of RMT last Friday and Mr. Royce did nothing on Monday but liquidate every security in the portfolio and return the proceeds to his investors, you would be guaranteed a 16% profit on your investment. Funds managed by David Dreman, Mario Gabelli, the Franklin Mutual Series team, Mark Mobius and others are selling at 5 – 25% discounts.

It’s common for CEFs to maintain modest discounts for long periods. A fund might sell at a 4% discount most of the time, reflecting either skepticism about the manager or the thinness of the market for the fund’s shares. The key to RNCOX’s strategy is the observation that those ongoing discounts occasionally balloon, so that a fund that normally sells at a 4% discount is temporarily available at a 24% discount. With time, those abnormal discounts revert to the mean: the 24% discount returns to being a 4% discount. If an investor knows what a fund’s normal discount is and buys shares of the fund when the discount is abnormally large, he or she will almost certainly profit when the discount reverts to normal. This tendency to generate panic discounts offers a highly-predictable source of “alpha,” largely independent of the skill of the manager whose CEF you’re buying and somewhat independent of what the market does (a discount can evaporate even when the overall market is flat, creating a profit for the discount investor). The key is understanding the CEF market well enough to know what a particular fund’s “normal” discount is and how long that particular fund might maintain an “abnormal” discount.

Enter Patrick Galley and the RiverNorth team. Mr. Galley used to work for Bank of America, analyzing mutual fund acquisition deals and arranging financing for them. That work led him to analyze the value of CEFs, whose irrational pricing led him to conclude that there were substantial opportunities for arbitrage and profits. After exploiting those opportunities in separately managed accounts, he left to establish his own fund.

RiverNorth Core’s portfolio is constructed in two steps: asset allocation and security selection. The fund starts with a core asset allocation, a set of asset classes which – over the long run – produce the best risk-adjusted returns. The core allocations include a 60/40 split between stocks and bonds, about a 60/40 split in the bond sleeve between government and high-yield bonds, about an 80/20 split in the stock sleeve between domestic and foreign, about an 80/20 split within the foreign stock sleeve between developed and emerging, and so on. But as any emerging markets investor knows from last year’s experience, the long-term attractiveness of an asset class can be interrupted by short periods of horrible losses. In response, RiverNorth makes opportunistic, tactical adjustments in its asset allocation. Based on an analysis of more than 30 factors (including valuation, liquidity, and sentiment), the fund can temporarily overweight or underweight particular asset classes.

Once the asset allocation is set, the managers look to implement the allocation by investing in a combination of CEFs and ETFs. In general, they’ll favor CEFs if they find funds selling at abnormal discounts. In that case, they’ll buy the CEF and hold it until the discount returns to normal. (I’ll note, in passing, that they can also short CEFs selling at abnormal premiums to the NAV.) They’ll then sell and if no other abnormally discounted CEF is available, they’ll buy an ETF in the same sector. If there are no inefficiently-priced CEFs in an area where they’re slated to invest, the fund simply buys ETFs.

In this way, the managers pursue profits from two different sources: a good tactical allocation (which other funds might offer) and the CEF arbitrage opportunity (which no other fund offers). Given the huge number of funds currently selling at double-digit discounts to the value of their holdings, it seems that RNCOX has ample opportunity for adding alpha beyond what other tactical allocation funds can offer.

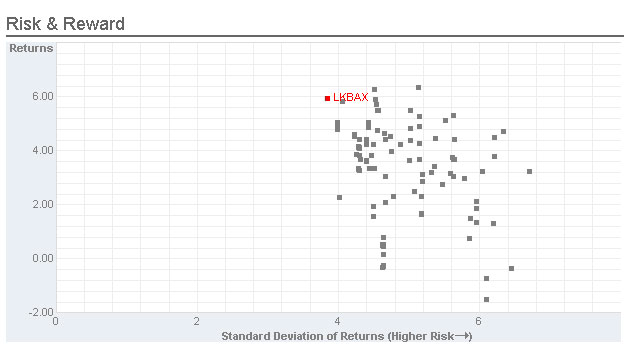

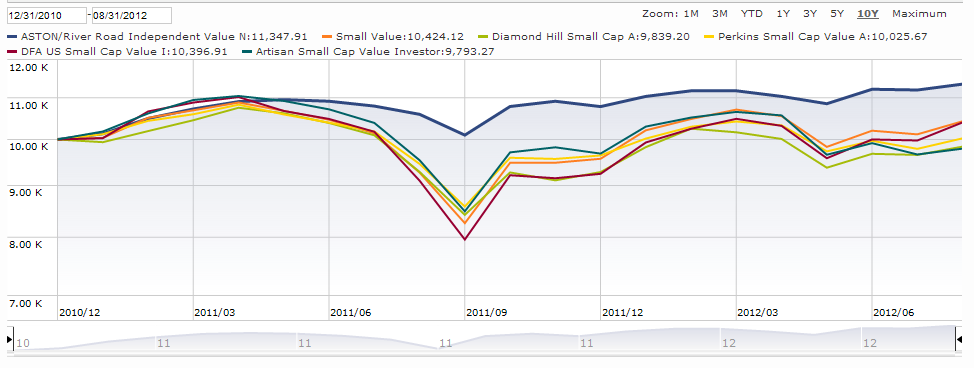

There are, as always, risks inherent in investing in the fund. The managers are experts at CEF investing, but much of the fund’s return is driven by asset allocation decisions and they don’t have a unique competitive advantage there. Since the fund sells a CEF as soon as it reverts to its normal discount, portfolio turnover is likely to be high (last year it was 300%) and tax efficiency will suffer. The fund’s expenses are much higher than those of typical no-load equity funds, though not out of line with expenses typical of long/short, market neutral, and tactical allocation funds. Finally, short-term volatility could be substantial: large CEF discounts can grow larger and the managers intend to buy more of those more-irrationally discounted shares. In Q3 2008, for example, the fund lost 15% – about three times as much as the Vanguard Balanced Index – but then went on to blow away the index over the following three quarters.

Bottom Line

For investors looking for a core fund, especially one in a Roth or other tax-advantaged account, RiverNorth Core really needs to be on your short list of best possible choices. The managers have outperformed their peer group in both up- and down-markets and their ability to exploit inefficient pricing of CEFs is likely great enough to overcome the effects of high expenses and still provide superior returns to their investors.

Fund website

© Mutual Fund Observer, 2011. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact David@MutualFundObserver.com.