Objective and Strategy

To provide high current return with less short-term risk than the stock market, the Fund buys and sells a combination of stocks, options, futures, and fixed-income securities. Up to 75% of the portfolio may be in stocks and options. They may short up to 35% via index futures. At least 25% must be in stocks and no more than 15% in foreign stocks. At least 25% will be in bonds, but those are short-term Treasuries with an average duration of five months (the manager refers to them as “the anchor rather than the sail” of the fund). They will, on average, hold 150-200 securities.

Adviser

Bridgeway Capital Management. The first Bridgeway fund – Ultra Small Company – opened in August of 1994. The firm has 11 funds and 60 or so separate accounts, with about $2 billion under management. Bridgeway’s corporate culture is famously healthy and its management ranks are very stable.

Managers

Richard Cancelmo is the lead portfolio manager and leads the trading team for Bridgeway. He joined Bridgeway in 2000 and has over 25 years of investment industry experience, including five years with Cancelmo Capital Management and The West University Fund. He has been the fund’s manager since inception.

Management’s stake

Mr. Cancelmo has been $100,000 and $500,000 invested in the fund. John Montgomery, Bridgeway’s president, has an investment in that same range. Every member of Bridgeway’s board of trustees also has a substantial investment in the fund.

Opening date

June 29, 2001.

Minimum investment

$2000 for both regular and tax-sheltered accounts.

Expense ratio

0.95% on assets of $29.8 million, as of June 2023.

Comments

They were one of the finest debate teams I encountered in 20 years. Two young men from Northwestern University. Quiet, in an activity that was boisterous. Clean-cut, in an era that was ragged. They pursued very few argumentative strategies, but those few were solid, and executed perfectly. Very smart, very disciplined, but frequently discounted by their opponents. Because they were unassuming and their arguments were relatively uncomplicated, folks made the (fatal) assumption that they’d be easy to beat. Toward the end of one debate, one of the Northwesterners announced with a smile: “Our strategy has worked perfectly. We have lulled them into mistakes. In dullness there is strength!”

Bridgeway Balanced is likewise. This fund has very few strategies but they are solid and executed perfectly. The portfolio is 25 – 75% mid- to large-cap domestic stocks, the remainder of the portfolio is (mostly Treasury) bonds. Within the stock portfolio, about 60% is indexed to the S&P 500 and 40% is actively managed using Bridgeway’s computer models. Within the actively managed part, half of the picks lean toward value and half toward growth. (Yawn.) But also – here’s the exciting dull part – particularly within the active portion of the portfolio, Mr. Cancelmo has the ability to substitute covered calls and secured puts for direct ownership of the stocks! (If you’re tingling now, it’s probably because your legs have fallen asleep.)

These are financial derivatives, called options. I’ve tried six different ways of writing a layperson’s explanation for options and they were all miserably unclear. Suffice it to say that the options are a tool to generate modest cash flows for the fund while seriously limiting the downside risk and somewhat limiting the upside potential. At base, the fund sacrifices some Alpha in order to seriously limit Beta. The strategy requires excellent execution or you’ll end up losing more on the upside than you gain on the downside.

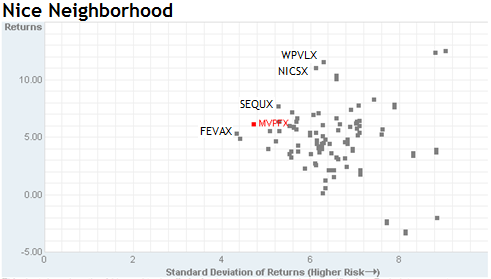

But Bridgeway seems to be executing exceedingly well. From inception through late December, 2012, BRBPX turned $10,000 into $15,000. That handily beats its long/short funds peer group ($12,500) and the 700-pound gorilla of option strategy funds, Gateway (GATEX, $14,200). Those returns are also better than those for the moderate allocation group, which exposes you to 60% of the stock market’s volatility against Bridgeway’s 40%. They’ve accomplished those gains with little volatility: for the past decade, their standard deviation is 7 (the S&P 500 is 15) and their beta is 0.41.

This occurs within the context of Bridgeway’s highly principled corporate structure: small operation, very high ethical standards, unwavering commitment to honest communication with their shareholders (if you need to talk to founder John Montgomery or Mr. Cancelmo, just call and ask – the phone reps are in the same office suite with them and are authorized to ring straight through), modest salaries (they actually report them – Mr. Cancelmo earned $423,839 in 2004 and the company made a $12,250 contribution to his IRA), a commitment to contribute 50% of their profits to charity, and a rule requiring folks to keep their investable wealth in the Bridgeway funds.

Very few people have chosen to invest in the fund – net assets are around $24 million, down from a peak of $130 million. Not just down, but steadily and consistently down even as performance has been consistently solid. I’ve speculated elsewhere about the cause of the decline: a mismatch with the rest of the Bridgeway line-up, a complex strategy that’s hard for outsiders to grasp and to have confidence in, and poor marketing among them. Given Bridgeway’s commitment to capping fees, the decline is sad and puzzling but has limited significance for the fund’s shareholders.

Bottom line

“In dullness, there is strength!” For folks who want some equity exposure but can’t afford the risk of massive losses, or for any investor looking to dampen the volatility of an aggressive portfolio, Bridgeway Managed Volatility – like Bridgeway, in general – deserves serious consideration.

Company website

[cr2013]