By Editor

This profile was updated in September 2012. You will find the updated profile at http://www.mutualfundobserver.com/2012/09/astonriver-road-independent-value-fund-arivx-updated-september-2012/

Objective and strategy

The fund seeks to provide long-term total return by investing in common and preferred stocks, convertibles and REITs. The manager attempts to invest in high quality, small- to mid-cap firms (those with market caps between $100 million and $5 billion). He thinks of himself as having an “absolute return” mandate, which means an exceptional degree of risk-consciousness. He’ll pursue the same style of investing as in his previous charges, but has more flexibility than before because this fund does not include the “small cap” name.

Adviser

Aston Asset Management, LP. It’s an interesting setup. As of June 30, 2012, Aston is the adviser to twenty-seven mutual funds with total net assets of approximately $10.5 billion and is a subsidiary of the Affiliated Managers Group. River Road Asset Management LLC subadvises six Aston funds; i.e., provides the management teams. River Road, founded in 2005, oversees $7 billion and is a subsidiary of the European insurance firm, Aviva, which manages $430 billion in assets. River Road also manages five separate account strategies, including the Independent Value strategy used here.

Manager

Eric Cinnamond. Mr. Cinnamond is a Vice President and Portfolio Manager of River Road’s independent value investment strategy. Mr. Cinnamond has 19 years of investment industry experience. Mr. Cinnamond managed the Intrepid Small Cap (ICMAX) fund from 2005-2010 and Intrepid’s small cap separate accounts from 1998-2010. He co-managed, with Nola Falcone, Evergreen Small Cap Equity Income from 1996-1998. In addition to this fund, he manages six smallish (collectively, about $50 million) separate accounts using the same strategy.

Management’s Stake in the Fund

As of October 2011, Mr. Cinnamond has between $100,000 and $500,000 invested in his fund. Two of Aston’s 10 trustees have invested in the fund. In general, a high degree of insider ownership – including trustee ownership – tends to predict strong performance. Given that River Road is a sub-advisor and Aston’s trustees oversee 27 funds each, I’m not predisposed to be terribly worried.

Opening date

December 30, 2010.

Minimum investment

$2,500 for regular accounts, $500 for various sorts of tax-advantaged products (IRAs, Coverdells, UTMAs).

Expense ratio

1.42%, after waivers, on $616 million in assets.

Update

Our original analysis, posted February, 2011, appears just below this update. It describes the fund’s strategy, Mr. Cinnamond’s rationale for it and his track record over the past 16 years. |

September, 2012

|

| 2011 returns: 7.8%, while his peers lost 4.5%, which placed ARIVX in the top 1% of comparable funds. 2012 returns, through 8/30: 5.3%, which places ARIVX in the bottom 13% of small value funds. |

|

| Asset growth: about $600 million in 18 months, from $16 million. The fund’s expense ratio did not change. |

|

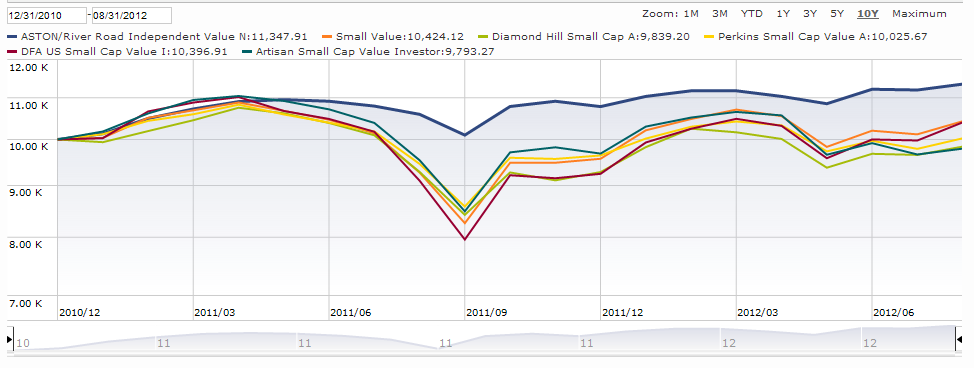

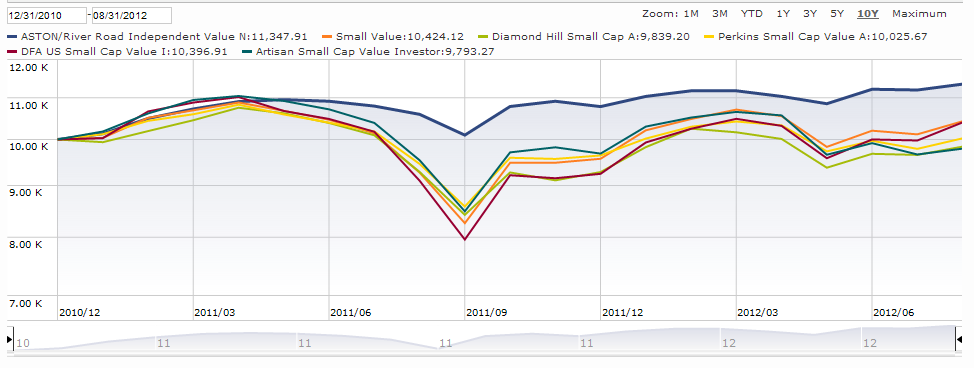

| What are the very best small-value funds? Morningstar has designated three as the best of the best: their analysts assigned Gold designations to DFA US Small Value (DFSVX), Diamond Hill Small Cap (DHSCX) and Perkins Small Cap Value (JDSAX). For my money (literally: I own it), the answer has been Artisan Small Cap(ARTVX).And where can you find these unquestionably excellent funds? In the chart below (click to enlarge), you can find them where you usually find them. Well below Eric Cinnamond’s fund.

That chart measures only the performance of his newest fund since launch, but if you added his previous funds’ performance you get the same picture over a longer time line. Good in rising markets, great in falling ones, far steadier than you might reasonably hope for.

Why? His explanation is that he’s an “absolute return” investor. He buys only very good companies and only when they’re selling at very good prices. “Very good prices” does not mean either “less than last year” or “the best currently available.” Those are relative measures which, he says, make no sense to him.

His insistence on buying only at the right price has two notable implications.

He’s willing to hold cash when there are few compelling values. That’s often 20-40% of the portfolio and, as of mid-summer 2012, is over 50%. Folks who own fully invested small cap funds are betting that Mr. Cinnamond’s caution is misplaced. They have rarely won that bet.

He’s willing to spend cash very aggressively when there are many compelling values. From late 2008 to the market bottom in March 2009, his separate accounts went from 40% cash to almost fully-invested. That led him to beat his peers by 20% in both the down market in 2008 and the up market in 2009.

This does not mean that he looks for low risk investments per se. It does mean that he looks for investments where he is richly compensated for the risks he takes on behalf of his investors. His July 2012 shareholder letter notes that he sold some consumer-related holdings at a nice profit and invested in several energy holdings. The energy firms are exceptionally strong players offering exceptional value (natural gas costs $2.50 per mcf to produce, he’s buying reserves at $1.50 per mcf) in a volatile business, which may “increase the volatility of [our] equity holdings overall.” If the market as a whole becomes more volatile, “turnover in the portfolio may increase” as he repositions toward the most compelling values.

The fund is apt to remain open for a relatively brief time. You really should use some of that time to learn more about this remarkable fund. |

Comments

While some might see a three-month old fund, others see the third incarnation of a splendid 16 year old fund.

The fund’s first incarnation appeared in 1996, as the Evergreen Small Cap Equity Income fund. Mr. Cinnamond had been hired by First Union, Evergreen’s advisor, as an analyst and soon co-manager of their small cap separate account strategy and fund. The fund grew quickly, from $5 million in ’96 to $350 million in ’98. It earned a five-star designation from Morningstar and was twice recognized by Barron’s as a Top 100 mutual fund.

In 1998, Mr. Cinnamond became engaged to a Floridian, moved south and was hired by Intrepid (located in Jacksonville Beach, Florida) to replicate the Evergreen fund. For the next several years, he built and managed a successful separate accounts portfolio for Intrepid, which eventually aspired to a publicly available fund.

The fund’s second incarnation appeared in 2005, with the launch of Intrepid Small Cap (ICMAX). In his five years with the fund, Mr. Cinnamond built a remarkable record which attracted $700 million in assets and earned a five-star rating from Morningstar. If you had invested $10,000 at inception, your account would have grown to $17,300 by the time he left. Over that same period, the average small cap value fund lost money. In addition to a five star rating from Morningstar (as of 2/25/11), the fund was also designated a Lipper Leader for both total returns and preservation of capital.

In 2010, Mr. Cinnamond concluded that it was time to move on. In part he was drawn to family and his home state of Kentucky. In part, he seems to have reassessed his growth prospects with the firm.

The fund’s third incarnation appeared on the last day of 2010, with the launch of Aston / River Road Independent Value (ARIVX). While ARIVX is run using the same discipline as its predecessors, Mr. Cinnamond intentionally avoided the “small cap” name. While the new fund will maintain its historic small cap value focus, he wanted to avoid the SEC stricture which would have mandated him to keep 80% of assets in small caps.

Over an extended period, Mr. Cinnamond’s small cap composite (that is, the weighted average of the separately managed accounts under his charge over the past 15 years) has returned 12% per year to his investors. That figure understates his stock picking skills, since it includes the low returns he earned on his often-substantial cash holdings. The equities, by themselves, earned 15.6% a year.

The key to Mr. Cinnamond’s performance (which, Morningstar observes, “trounced nearly all equity funds”) is achieved, in his words, “by not making mistakes.” He articulates a strong focus on absolute returns; that is, he’d rather position his portfolio to make some money, steadily, in all markets, rather than having it alternately soar and swoon. There seem to be three elements involved in investing without mistakes:

- Buy the right firms.

- At the right price.

- Move decisively when circumstances demand.

All things being equal, his “right” firms are “steady-Eddy companies.” They’re firms with look for companies with strong cash flows and solid operating histories. Many of the firms in his portfolio are 50 or more years old, often market leaders, more mature firms with lower growth and little debt.

Like many successful managers, Mr. Cinnamond pursues a rigorous value discipline. Put simply, there are times that owning stocks simply aren’t worth the risk. Like, well, now. He says that he “will take risks if I’m paid for it; currently I’m not being paid for taking risk.” In those sorts of markets, he has two options. First, he’ll hold cash, often 20-30% of the portfolio. Second, he moves to the highest quality companies in “stretched markets.” That caution is reflected in his 2008 returns, when the fund dropped 7% while his benchmark dropped 29%.

But he’ll also move decisively to pursue bargains when they arise. “I’m willing to be aggressive in undervalued markets,” he says. For example, ICMAX’s portfolio went from 0% energy and 20% cash in 2008 to 20% energy and no cash at the market trough in March, 2009. Similarly, his small cap composite moved from 40% cash to 5% in the same period. That quick move let the fund follow an excellent 2008 (when defense was the key) with an excellent 2009 (where he was paid for taking risks). The fund’s 40% return in 2009 beat his index by 20 percentage points for a second consecutive year. As the market began frothy in 2010 (“names you just can’t value are leading the market,” he noted), he let cash build to nearly 30% of the portfolio. That meant that his relative returns sucked (bottom 10%), but he posted solid absolute returns (up 20% for the year) and left ICMAX well-positioned to deal with volatility in 2011.

Unfortunately for ICMAX shareholders, he’s moved on and their fund trailed 95% of its peers for the first couple months of 2011. Fortunately for ARIVX shareholders, his new fund is leading both ICMAX and its small value peers by a comfortable early margin.

The sole argument against owning is captured in Cinnamond’s cheery declaration, “I like volatility.” Because he’s unwilling to overpay for a stock, or to expose his shareholders to risk in an overextended market, he sidelines more and more cash which means the fund might lag in extended rallies. But when stocks begin cratering, he moves quickly in which means he increases his exposure as the market falls. Buying before the final bottom is, in the short term, painful and might be taken, by some, as a sign that the manager has lost his marbles. He’s currently at 40% cash, effectively his max, because he hasn’t found enough opportunities to fill a portfolio. He’ll buy more as prices on individual stocks because attractive, and could imagine a veritable buying spree when the Russell 2000 is at 350. At the end of February 2011, the index was close to 700.

Bottom Line

Aston / River Road Independent Value is the classic case of getting something for nothing. Investors impressed with Mr. Cinnamond’s 15 year record – high returns with low risk investing in smaller companies – have the opportunity to access his skills with no higher expenses and no higher minimum than they’d pay at Intrepid Small Cap. The far smaller asset base and lack of legacy positions makes ARIVX the more attractive of the two options. And attractive, period.

Fund website

Aston/River Road Independent Value

[cr2012]