By David Snowball

Dear friends,

I had imagined this as the “post-storm, pre-cliff” edition of the Observer but it appears that “post-storm” would be a very premature characterization. For four million of our friends who are still without power, especially those along the coast or in outlying areas, the simple pleasures of electric lighting and running water remain a distant hope. And anything that looks like “normal” might be months in their future. Our thoughts, prayers, good wishes and spare utility crews go out to them.

I thought, instead, I’d say something about the U.S. presidential election. This is going to sting, but here it is:

It’s going to be okay.

Hard to believe, isn’t it? We’re acculturated into viewing the election if as it were some apocalyptic video game whose tagline reads: “America can’t survive .” The reality is, we can and we will. The reality is that both Obama and Romney are good guys: smart, patriotic, obsessively hard-working, politically moderate, fact-driven, given to compromise and occasionally funny. The reality is that they’re both trapped by the demands of electoral politics and polarized bases.

But, frankly, freed of the constraints of those bases, these guys would agree on rather more than they disagree on. In a less-polarized world, they could run together as a ticket (Obomney 2020!) and do so with a great deal of camaraderie and mutual respect. (Biden-Ryan, on the other hand, would be more than a little bit scary.) Neither strikes me as a great politician or polished communicator; that’s going to end up constraining – and perhaps crippling – whoever wins.

Why are we so negative? Because negative (“fear and loathing on the campaign trail”) raises money (likely $6 billion by the time it’s all done) and draws viewers. While it’s easy to blame PACs, super PACs and other dark forces for that state, the truth is that the news media – mainstream and otherwise – paint good men as evil. A startling analysis conducted by the Project for Excellence in Journalism found that 72% of all character references to Messrs. Obama and Romney are negative, one of the most negative set of press portrayals on record.

I live in Iowa, labeled a “battleground state,” and I receive four to six (largely poisonous) robo-calls a day. And so here’s the final reality: Iowa is not a battleground and we’d all be better off if folks stopped using the term. It’s a place where a bunch of folks are worried, a bunch of folks (often the same ones) are hopeful and we’re trying to pick as best we can.

The Last Ten: T. Rowe Price in the Past Decade

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade. We started with Fidelity, once fabled for the predictable success of its new fund launches. Sadly, the pattern of the last decade is clear and clearly worse: despite 154 fund launches since 2002, Fidelity has created no compelling new investment option and only one retail fund that has earned Morningstar’s five-star designation, Fidelity International Growth (FIGFX). We suggested three causes: the need to grow assets, a cautious culture and a firm that’s too big to risk innovative funds.

T. Rowe Price is a far smaller firm. Where Fidelity has $1.4 trillion in assets under management, Price is under $600 billion. Fidelity manages 340 funds. Price has 110. Fidelity launched 154 funds in a decade, Price launched 22.

|

Morningstar Rating

|

Category

|

Size (millions, slightly rounded)

|

| Africa & Middle |

★★★ |

Emerging Markets Stock |

150

|

| Diversified Mid Cap Growth |

★★★ |

Mid-Cap Growth |

200

|

| Emerging Markets Corporate Bond |

—

|

Emerging Markets Bond |

30

|

| Emerging Markets Local Currency |

—

|

Emerging Markets Bond |

50

|

| Floating Rate |

—

|

Bank Loan |

80

|

| Global Infrastructure |

—

|

Global Stock |

40

|

| Global Large-Cap |

★★★ |

Global Stock |

70

|

| Global Real Estate |

★★★★★ |

Global Real Estate |

100

|

| Inflation Protected Bond |

★★★ |

Inflation-Protected Bond |

570

|

| Overseas Stock |

★★★ |

Foreign Large Blend |

5,000

|

| Real Assets |

—

|

World Stock |

2,760

|

| Retirement 2005 |

★★★★ |

Target Date |

1,330

|

| Retirement 2010 |

★★★ |

Target Date |

5,850

|

| Retirement 2015 |

★★★★ |

Target Date |

7,340

|

| Retirement 2025 |

★★★ |

Target Date |

9,150

|

| Retirement 2035 |

★★★★ |

Target Date |

6,220

|

| Retirement 2045 |

★★★★ |

Target Date |

3,410

|

| Retirement 2050 |

★★★★ |

Target Date |

2,100

|

| Retirement 2055 |

★★★★★ |

Target-Date |

490

|

| Retirement Income |

★★★ |

Retirement Income |

2,870

|

| Strategic Income |

★★ |

Multisector Bond |

270

|

| US Large-Cap Core |

★★★ |

Large Blend |

50

|

What are the patterns?

- Most Price funds reflect the firm’s strength in asset allocation and emerging asset classes. Price does really first-rate work in thinking about which assets classes make sense and in what configuration. They’ve done a good job of communicating that research to their investors, making things clear without making them childish.

- Most Price funds succeed. Of the funds launched, only Strategic Income (PRSNX) has been a consistent laggard; it has trailed its peer group in four consecutive years but trailed disastrously only once (2009).

- Most Price funds remain reasonably nimble. While Fido funds quickly swell into the multi-billion range, a lot of the Price funds have remaining under $200 million which gives them both room to grow and to maneuver. The really large funds are the retirement-date series, which are actually funds of other funds.

- Price continues to buck prevailing wisdom. There’s no sign of blossoming index fund business or the launch of a series of superfluous ETFs. There’s a lot to be said for knowing your strengths and continuing to develop them.

Finally, Price continues to deliver on its promises. Investing with Price is the equivalent of putting a strong singles-hitter on a baseball team; it’s a bet that you’ll win with consistency and effort, rather than the occasional spectacular play. The success of that strategy is evident in Price’s domination of . . .

The Observer’s Honor Roll, Unlike Any Other

Last month, in the spirit of FundAlarm’s “three-alarm” fund list, we presented the Observer’s second Roll Call of the Wretched. Those were funds that managed to trail their peers for the past one-, three-, five- and ten-year periods, with special commendation for the funds that added high expenses and high volatility to the mix.

This month, I’d like to share the Observer’s Honor Roll of Consistently Bearable Funds. Most such lists start with a faulty assumption: that high returns are intrinsically good.

Wrong!

While high returns can be a good thing, the practical question is how those returns are obtained. If they’re the product of alternately sizzling and stone cold performances, the high returns are worse than meaningless: they’re a deadly lure to hapless investors and advisors. Investors hate losing money much more than they love making it.

In light of that, the Observer asked a simple question: which mutual funds are never terrible? In constructing the Honor Roll, we did not look at whether a fund ever made a lot of money. We looked only at whether a fund could consistently avoid being rotten. Our logic is this: investors are willing to forgive the occasional sub-par year, but they’ll flee in terror in the face of a horrible one. That “sell low” – occasionally “sell low and stuff the proceeds in a zero-return money fund for five years” – is our most disastrous response.

We looked for no-load, retail funds which, over the past ten years, have never finished in the bottom third of their peer groups. And while we weren’t screening for strong returns, we ended up with a list of funds that consistently provided them anyway.

U.S. stock funds

|

Strategy

|

Assets (millions)

|

2011 Honoree or the reason why not

|

| Fidelity Growth Company (FDGRX) |

Large Growth

|

44,100

|

Rotten 2002

|

| Laudus Growth Investors US Large Cap Growth (LGILX) |

Large Growth

|

1,400

|

2011 Honoree

|

| Merger (MERFX) |

Market Neutral

|

4,700

|

Rotten 2002

|

| Robeco All Cap Value (BPAVX) |

Large Value

|

400

|

Not around in 2002

|

| T. Rowe Price Capital Opportunities (PRCOX) |

Large Blend

|

400

|

2011 Honoree

|

| T. Rowe Price Mid-Cap Growth (RPMGX) |

Mid-Cap Growth

|

18,300

|

2011 Honoree

|

| TIAA-CREF Growth & Income (TIIRX) |

Large Blend

|

2,900

|

Not around in 2002

|

| TIAA-CREF Mid-Cap Growth (TCMGX) |

Mid-Cap Growth

|

1,300

|

Not around in 2002

|

| Vanguard Explorer (VEXPX) |

Small Growth

|

9,000

|

2011 Honoree

|

| Vanguard Mid Cap Growth (VMGRX) |

Mid-Cap Growth

|

2,200

|

2011 Honoree

|

| Vanguard Morgan Growth (VMRGX) |

Large Growth

|

9,000

|

2011 Honoree

|

International stock funds

| American Century Global Growth (TWGGX) |

Global

|

400

|

2011 Honoree

|

| Driehaus Emerging Markets Growth (DREGX) |

Emerging Markets

|

900

|

2011 Honoree

|

| Thomas White International (TWWDX) |

Large Value

|

600

|

2011 Honoree

|

| Vanguard International Growth (VWIGX) |

Large Growth

|

17,200

|

2011 Honoree

|

Blended asset funds

| Buffalo Flexible Income (BUFBX) |

Moderate Hybrid

|

600

|

2011 Honoree

|

| Fidelity Freedom 2020 (FFFDX) |

Target Date

|

14,300

|

2011 Honoree

|

| Fidelity Freedom 2030 (FFFEX) |

Target Date

|

11,000

|

Rotten 2002

|

| Fidelity Puritan (FPURX) |

Moderate Hybrid

|

20,000

|

2011 Honoree

|

| Manning & Napier Pro-Blend Extended Term (MNBAX) |

Moderate Hybrid

|

1,300

|

2011 Honoree

|

| T. Rowe Price Balanced (RPBAX) |

Moderate Hybrid

|

3,400

|

2011 Honoree

|

| T. Rowe Price Personal Strategy Balanced (TRPBX) |

Moderate Hybrid

|

1,700

|

2011 Honoree

|

| T. Rowe Price Personal Strategy Income (PRSIX) |

Conservative Hybrid

|

1,100

|

2011 Honoree

|

| T. Rowe Price Retirement 2030 (TRRCX) |

Target Date

|

13,700

|

Not around in 2002

|

| T. Rowe Price Retirement 2040 (TRRDX) |

Target Date

|

9,200

|

Not around in 2002

|

| T. Rowe Price Retirement Income (TRRIX) |

Retirement Income

|

2,900

|

Not around in 2002

|

| Vanguard STAR (VGSTX) |

Moderate Hybrid

|

14,800

|

2011 Honoree

|

| Vanguard Tax-Managed Balanced (VTMFX) |

Conservative Hybrid

|

1,000

|

Rotten 2002

|

Specialty funds

| Fidelity Select Industrials (FCYIX) |

Industrial

|

600

|

Weak 2002

|

| Fidelity Select Retailing (FSRPX) |

Consumer Cyclical

|

600

|

Weak 2002

|

| Schwab Health Care (SWHFX) |

Health

|

500

|

2011 Honoree

|

| T. Rowe Price Global Technology (PRGTX) |

Technology

|

700

|

2011 Honoree

|

| T. Rowe Price Media & Telecomm (PRMTX) |

Communications

|

2,400

|

2011 Honoree

|

Reflections on the Honor Roll

These funds earn serious money. Twenty-nine of the 33 funds earn four or five stars from Morningstar. Four earn three stars, and none earn less. By screening for good risk management, you end up with strong returns.

This is consistent with the recent glut of research on low-volatility investing. Here’s the basic story: a portfolio of low-volatility stocks returns one to two percent more than the stock market while taking on 25% less risk.

That’s suspiciously close to the free lunch we’re not supposed to get.

There’s a very fine, short article on low-volatility investing in the New York Times: “In Search of Funds that Don’t Rock the Boat” (October 6, 2012). PIMCO published some of the global data, showing (at slightly numbing length) that the same pattern holds in both developed and developing markets: “Stock Volatility: Not What You Might Think” (January 2012). There are a slug of ETFs that target low-volatility stocks but I’d be hesitant to commit to one until we’d looked at other risk factors such as turnover, market cap and sector concentration.

The roster is pretty stable. Only four funds that qualified under these screens at the end of 2011 dropped out in 2012. They are:

FPA Crescent (FPACX) – a 33% cash stake isn’t (yet) helping. That said, this has been such a continually excellent fund that I worry more about the state of the market than about the state of Crescent.

New Century Capital (NCCPX) – a small, reasonably expensive fund-of funds that’s trailing 77% of its peers this year. It’s been hurt, mostly, by being overweight in energy and underweight in resurgent financials.

New Century International (NCFPX) – another fund-of-funds that’s trailing about 80% of its peers, hurt by a huge overweight in emerging markets (primarily Latin), energy, and Canada (which is sort of an energy play).

Permanent Portfolio (PRPFX) – it hasn’t been a good year to hold a lot of Treasuries, and PRPFX by mandate does.

The list shows less than half of the turnover you’d expect if funds were there by chance.

One fund deserves honorable mention. T. Rowe Price Capital Appreciation (PRCWX) has only had one relatively weak year in this century; in 2007, it finished in the 69th percentile which made it (barely) miss inclusion.

What you’ve heard about T. Rowe Price is true. You know all that boring “discipline, consistency, risk-awareness” stuff. Apparently so. There are 10 Price funds on the list, nearly one-third of the total. Second place: Fidelity and Vanguard, far larger firms, with six funds.

Sure bets? Nope. Must have? Dear God, no. A potentially useful insight into picking winners by dodging a penchant for the occasional disaster? We think so.

In dullness there is strength.

“TrimTabs ETF Outperforms Hedge Funds”

And underperforms pretty much everybody else. The nice folks at FINAlternatives (“Hedge Fund and Private Equity News”) seem to have reproduced (or condensed) a press release celebrating the first-year performance of TrimTabs Float Shrink ETF (TTFS).

(Sorry – you can get to the original by Googling the title but a direct-link always takes you to a log-in screen.)

Why is this journalism? They don’t offer the slightest hint about what the fund does. And, not to rain on anybody’s ETF, but their trailing 12-month return (21.46% at NAV, as of 10/18) places them 2050th in Morningstar’s database. That list includes a lot of funds which have been consistently excellent (Akre Focus, BBH Core Select (closing soon – see below), ING Corporate Leaders, Mairs & Power Growth and Sequoia) for decades, so it’s not immediately clear what warrants mention.

Seafarer Rolls On

Andrew Foster’s Seafarer Overseas Growth & Income Fund (SFGIX) continues its steady gains.

The fund is outperforming every reasonable benchmark: $10,000 invested at the fund’s inception has grown to $10,865 (as of 10/26/12). The same amount invested in the S&P’s diversified emerging markets, emerging Asia and emerging Latin America ETFs would have declined by 5-10%.

Assets are steadily rolling in: the fund is now at $17 million after six months of operation and has been gaining nearly two million a month since summer.

Opinion-makers are noticing: Andrew and David Nadel of Royce Global Value (and five other funds ‘cause that’s what Royce managers do) were the guests on October 26th edition of Wealth Track with Consuelo Mack. It was good to hear ostensible “growth” and “value” investors agree on so much about what to look for in emerging market stocks and which countries they were assiduously avoiding. The complete interview on video is available here. (Thanks to our endlessly vigilant Ted for both the heads-up and the video link.)

Legg Mason Rolls Over

Legg Mason seems to be struggling. On the one hand we have the high visibility struggles of its former star manager, Bill Miller, who’s now in the position of losing more money for more people than almost any manager. Their most recent financial statement, released July 27, shows that assets, operating revenue, operating income, and earnings are all down from the year before. Beside that, there’s a more fundamental struggle to figure out what Legg Mason is and who wants to bear the name.

On October 5 2009 Legg announced a new naming strategy for its funds:

Most funds that were formerly named Legg Mason or Legg Mason Partners will now include the Legg Mason name, the name of the investment affiliate and the Fund’s strategy (such as the Legg Mason ClearBridge Appreciation Fund or the Legg Mason Western Asset Managed Municipals Fund).

The announced rationale was to “leverage the Legg Mason brand awareness.”

Welcome to the age of deleveraging: This year those same funds are moving to hide the Legg Mason taint. Western Asset dropped the Legg Mason number this summer. Clearbridge is now following suit, so that the Legg Mason ClearBridge Appreciation Fund is about to become just Clearbridge Appreciation.

Royce, another Legg Mason affiliate, has never advertised that association. Royce has always had a great small-value discipline. Since being acquired by Legg Mason in 2001, the firm acquired two other, troubling distinctions.

- Managers who are covering too many funds. By way of a quick snapshot, here are the funds managed by 72-year-old Chuck Royce (and this is after he dropped several):

| Since … |

He’s managed … |

|

12/2010

|

Royce Global Dividend Value |

|

08/2010

|

Royce Micro-Cap Discovery |

|

04/2009

|

Royce Partners |

|

06/2008

|

Royce International Smaller-Companies |

|

09/2007

|

Royce Enterprise Select |

|

12/2006

|

Royce European Smaller Companies |

|

06/2005

|

Royce Select II |

|

05/2004

|

Royce Dividend Value |

|

12/2003

|

Royce Financial Services |

|

06/2003

|

Royce 100 |

|

11/1998

|

Royce Select I |

|

12/1995

|

Royce Heritage |

|

12/1993

|

Royce Total Return |

|

12/1991

|

Royce Premier |

|

11/1972

|

Royce Pennsylvania Mutual |

Their other senior manager, Whitney George, manages 11 funds. David Nadel works on nine, Lauren Romeo helps manage eight.

- A wild expansion out of their traditional domestic small-value strength. Between 1962 and 2001, Royce launched nine funds – all domestic small caps. Between 2001 and the present, they launched 21 mutual funds and three closed-end funds in a striking array of flavors (Global Select Long/Short, International Micro-Cap, European Smaller Companies). While many of those later launches have performed well, many have found no traction in the market. Fifteen of their post-2001 launches have under $100 million in assets, 10 have under $10 million. That translates into higher expenses in some already-expensive niches and a higher hurdle for the managers to overcome.Legg reports progressively weaker performance among the Royce funds in recent years:

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

That might be a sign of a fundamentally unhealthy market or the accumulated toll of expenses and expansion. Shostakovich, one of our discussion board’s most experienced correspondents, pretty much cut to the chase on the day Royce reopened its $1.1 billion micro-cap fund to additional investors: “Chuck sold his soul. He kept his cashmere sweaters and his bow ties, but he sold his soul. And the devil’s name is Legg Mason.” Interesting speculation.

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve. This month’s lineup features

Scout Unconstrained Bond (SUBFX): If these guys have a better track record than the one held by any bond mutual fund (and they do), why haven’t you heard of it? Worse yet, why hadn’t I?

Stewart Capital Mid-Cap (SCMFX): If this is one of the top two or three or ten mid-cap funds in operation (and it is), why haven’t you heard of it? Worse yet, why hadn’t I?

Launch Alert: RiverNorth Dynamic Buy-Write Fund (RNBWX)

On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

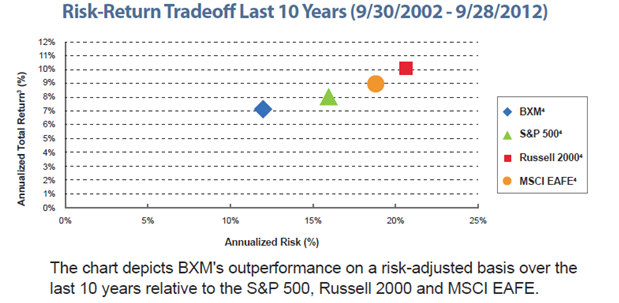

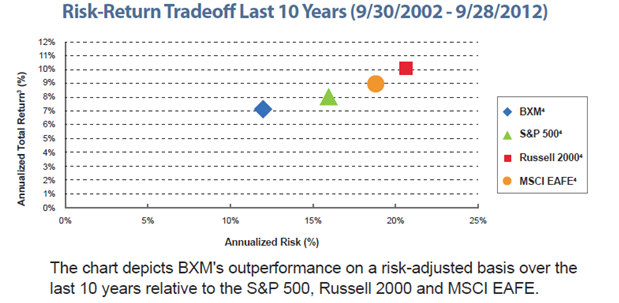

As with any defensive strategy, you end up surrendering some upside in order to avoid some of the downside. RiverNorth’s launch announcement contained a depiction of the risk-return profiles for a common buy-write index (the BXM) and three classes of stock:

A quick read is that the BXM offered 90% of the upside of the stock market with only 70% of the downside, which seems the very definition of a good tradeoff.

RiverNorth believes they can do better through active management of the portfolio. The fund will be managed by Eric Metz, who joined RiverNorth in 2012 and serves as their Derivatives Strategist. He’s been a partner at Bengal Capital, a senior trader at Ronin Capital and worked at the Chicago Mercantile Exchange (CME) and Chicago Board Options Exchange (CBOE). The investment minimum is $5000. Expenses are capped at 1.80%.

Because the strategy is complex, the good folks at RiverNorth have agreed to an extended interview at their offices in Chicago on November 8th. With luck and diligence, we’ll provide a full profile of the fund in our December issue.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details. Every day we scour new SEC filings to see what opportunities might be about to present themselves. Many of the proposed funds offer nothing new, distinctive or interesting. Some are downright horrors of Dilbertesque babble.

Twenty-nine new no-load funds were placed in registration this month. Those include three load-bearing funds becoming no-loads, two hedge funds merging to become one mutual fund, one institutional fund becoming retail and two dozen new offerings. An unusually large number of the new funds feature very experienced managers. Four, in particular, caught our attention:

BBH Global Core Select is opening just as the five-star BBH Core Select closes. Core Select invests about 15% of its money outside the U.S., while the global version will place at least 40% there. One of Core Select’s managers will co-manage the new fund with a BBH analyst.

First Trust Global Tactical Asset Allocation and Income Fund will be an actively-managed ETF that “seek[s] total return and provide income [and] a relatively stable risk profile.” The managers, John Gambla and Rob A. Guttschow, had been managing five closed-end funds for Nuveen.

Huber Capital Diversified Large Cap Value Fund, which will invest in 40-80 large caps that trade “at a significant discount to the present value of future cash flows,” will be run by Joseph Huber, who also manages the five-star Huber Small Cap Value (HUSIX) and Huber Equity Income (HULIX) funds.

Oakseed Opportunity Fund is a new global fund, managed by Greg L. Jackson and John H. Park. These guys managed or co-managed some “A” tier funds (Oakmark Global, Acorn, Acorn Select and Yacktman) before moving to Blum Capital, a private equity firm, from about 2004-2012.

Details on these funds and the list of all of the funds in registration are available at the Observer’s Funds in Registration page or by clicking “Funds” on the menu atop each page.

On a related note, we also tracked down about 50 fund manager changes, including the blockbuster announcement of Karen Gaffney’s departure from Loomis Sayles.

RiverPark Long/Short Opportunity conference call

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

The folks at RiverPark generously agreed to participate in a second conference call with Observer readers. It will feature Mitch Rubin, lead manager of RiverPark Long/Short Opportunity (RLSFX), a fund that we profiled in August as distinctive and distinctly promising. This former hedge fund crushed its peers.

I’ll moderate the call. Mitch will open by talking a bit about the fund’s strategy and then will field questions (yours and mine) on the fund’s strategies and prospects. The call is November 29 at 7:00 p.m., Eastern. Participants can register for the conference by navigating to http://services.choruscall.com/diamondpass/registration?confirmationNumber=10020992

We’ll have the winter schedule in our December issue. For now, I’ll note that managers of several really good funds have indicated a willingness to spend serious time with you.

Small Funds Communicating Smartly

The Mutual Fund Education Alliance announced their 2012 STAR Awards, which recognize fund companies that do a particularly good job of communicating with their investors. As is common with such awards, there’s an impulse to make sure lots of folks get to celebrate so there are 17 sub-categories in each of three channels (retail, advisor, plan participant) plus eleven overall winners, for 62 awards in total.

US Global Investors was recognized as the best small firm overall, for “consistency of messaging and excellent use of the various distribution outlets.” Matthews Asia was celebrated as the outstanding mid-sized fund firm. Judges recognized them for “modern, effective design [and] unbelievable branding consistency.”

Ironically, MFEA’s own awards page is danged annoying with an automatic slide presentation that makes it hard to read about any of the individual winners.

Congratulations to both firms. We’d also like to point you to our own Best of the Web winners for most effective site design: Seafarer Funds and Cook & Bynum Fund, with honorable mentions to Wintergreen, Auxier Focus and the Tilson Funds.

Briefly Noted . . .

Artio meltdown continues. The Wall Street Journal reports that Richard Pell, Artio’s CEO, has stepped down. Artio is bleeding assets, having lost nearly 50% of their assets under management in the past 12 months. Their stock price is down 90% since its IPO and we’d already reported the closure of their domestic-equity funds. This amounts to a management reshuffle, with Artio’s president becoming CEO and Pell remaining at CIO. He’ll also continue to co-manage the once-great (top 5% over 15 years, bottom 5% over the past five years) Artio International Equity Fund (BJBIX) with Rudolph-Riad Younes.

SMALL WINS FOR INVESTORS

Dreyfus/The Boston Company Small Cap Growth Fund (SSETX) reopened to new investors on November 1, 2012. It’s a decent little fund with below average expenses. Both risk and return tend to be below average as well, with risk further below average than returns.

Fidelity announced the launch of a dozen new target-date funds in its Strategic Advisers Multi-Manager Series, 2020 through 2055 and Retirement Income. The Multi-Manager series allows Fidelity to sell the skills of non-Fidelity managers (and their funds) to selected retirement plans. Christopher Sharpe and Andrew Dierdorf co-manage all of the funds.

CLOSINGS

The board of BBH Core Select (BBTEX) has announced its imminent closure. The five-star large cap fund has $3.2 billion in assets and will close at $3.5 billion. Given its stellar performance and compact 30-stock portfolio, that’s certainly in its shareholders’ best interests. At the same time, BBH has filed to launched a Global Core fund by year’s end. It will be managed by one of BBTEX’s co-managers. For details, see our Funds in Registration feature.

Invesco Balanced-Risk Commodity Strategy (BRCAX) will close to new investors effective November 15, 2012.

Investment News reports that 86 ETFs ceased operations in the first 10 months of 2012. Wisdom Tree announced three more in late October (LargeCap Growth ROI, South African Rand SZR and Japanese Yen JYF). Up until 2012, the greatest number of closures in a single calendar year was 58 during the 2008 meltdown. 400 more (Indonesian Small Caps, anyone?) reside on the ETF Deathwatch for October 2012; ETFs with tiny investor bases and little trading activity. The hidden dimension of the challenge provided by small ETFs is the ability of their boards to dramatically change their investment mandates in search of new assets. Investors in Global X S&P/TSX Venture 30 Canada ETF (think “Canadian NASDAQ”) suddenly found themselves instead in Global X Junior Miners ETF (oooo … exposure to global, small-cap nickel mining!).

OLD WINE, NEW BOTTLES

Under the assumption that indecipherable is good, Allianz announced three name changes: Allianz AGIC Structured Alpha Fund is becoming AllianzGI Structured Alpha Fund. Allianz AGIC U.S. Equity Hedged Fund becomes AllianzGI U.S. Equity Hedged Fund and Allianz NFJ Emerging Markets Value Fund becomes AllianzGI NFJ Emerging Markets Value Fund.

BBH Broad Market (BBBIX) has changed its name to BBH Limited Duration Fund.

Effective December 3, 2012, the expensive, small and underperforming Forward Aggressive Growth Allocation Fund (ACAIX) will be changed to the Forward Multi-Strategy Fund. Along with the new name, this fund of funds gets to add “long/short, tactical and other alternative investment strategies” to its armamentarium. Presumably that’s driven by the fact that the fund does quite poorly in falling markets: it has trailed its benchmark in nine of the past nine declining quarters. Sadly, adding hedge-like funds to the portfolio will only drive up expenses and serve as another drag on performance.

Schwab Premier Income (SWIIX) will soon become Schwab Intermediate-Term Bond, with lower expenses but a much more restrictive mandate. At the moment the fund can go anywhere (domestic, international and emerging market debt, income- and non-income-producing equities, floating rate securities, REITs, ETFs) but didn’t, while the new fund will invest only in domestic intermediate term bonds.

Moving in the opposite direction, Alger Large Cap Growth Institutional (ALGRX) becomes Alger Capital Appreciation Focus at the end of the year. The fund will adopt an all-cap mandate, but will shrink the target portfolio size from around 100 stocks to 50.

OFF TO THE DUSTBIN OF HISTORY

The Board of Directors of Bhirud Funds Inc. has approved the liquidation of Apex Mid Cap Growth Fund (BMCGX) effective on or about November 14, 2012. In announcing Apex’s place on our 2012 “Roll Call of the Wretched,” we noted:

The good news: not many people trust Suresh Bhirud with their money. His Apex Mid Cap Growth (BMCGX) had, at last record, $192,546 – $100,000 below last year’s level. Two-thirds of that amount is Mr. Bhirud’s personal investment. Mr. Bhirud has managed the fund since its inception in 1992 and, with annualized losses of 9.2% over the past 15 years, has mostly impoverished himself.

We’re hopeful he puts his remaining assets in a nice, low-risk index fund.

The Board of Trustees of Dreyfus Investment Funds approved the liquidation of Dreyfus/The Boston Company Small Cap Tax-Sensitive Equity Fund (SDCEX) on January 8, 2013. Ironically, this fund has outperformed the larger, newly-reopened SSETX. And, while they were at it, the Board also approved the liquidation of Dreyfus Small Cap Fund (the “Fund”), effective on January 16, 2013

ING will liquidate ING Alternative Beta (IABAX) on December 7, 2012. In addition to an obscure mandate (what is alternative beta?), the fund has managed to lose money over the past three years while drawing only $18 million in assets.

Munder International Equity Fund (MUIAX) is slated to be merged in Munder International Fund — Core Equity (MAICX), on December 7, 2012.

Uhhh . . .

Don’t get me wrong. MUIAX is a bad fund (down 18% in five years) and deserves to go. But MAICX is a worse fund by far (it’s down 29% in the same period). And much smaller. And newer.

This probably explains why I could never serve on a fund’s board of directors. Their logic is simply too subtle for me.

Royce Mid-Cap (RMIDX) is set to be liquidated on November 19, 2012. It’s less than three years old, has performed poorly and managed to draw just a few million in assets. The management team is being dispersed among Royce’s other funds.

It was named Third Millennium Russia Fund (TMRFX) and its charge was to invest “in securities of companies located in Russia.” This is a fund that managed to gain or lose more than 70% in three of the past 10 years. Investors have largely fled and so, effective October 10, 2012, the board of trustees tweaked things. It’s now called Toreador International Fund and its mandate is to invest “outside of the United States.” As of this writing, Morningstar had not yet noticed.

In Closing . . .

We’ve added an unusual bit of commercial presence, over to your right. Amazon created a mini-site dedicated to the interests of investors. In addition to the inevitable links to popular investing books, it features a weekly blog post, a little blog aggregator at the bottom (a lot of content from Bloomberg, some from Abnormal Returns and Seeking Alpha), and some sort of dead, dead, dead discussion group. We thought you might find some of it useful or at least browseable, so we decided to include it for you.

And yes, it does carry MFO’s embedded link. Thanks for asking!

Thanks, too, to all the folks (Gary, Martha, Dean, Richard, two Jacks, and one Turtle) who contributed to the Observer in October.

We’ll look for you in December.

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period. On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

On October 12, 2012, RiverNorth launched their fourth fund, RiverNorth Dynamic Buy-Write Fund. “Buy-write” describes a sort of “covered call” strategy in which an investor might own a security and then sell to another investor the option to buy the security at a preset price in a preset time frame. It is, in general, a defensive strategy which generates a bit of income and some downside protection for the investor who owns the security and writes the option.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

It’s the time of year when we pause to enjoy two great German traditions: Oktoberfest and Schadenfreude. While one of my favorites, Leinenkugel’s Oktoberfest, was shut out (Bent River Brewery won first, second and third places at the Quad City’s annual Brew Ha Ha festival), it was a great excuse to celebrate fall on the Mississippi.

It’s the time of year when we pause to enjoy two great German traditions: Oktoberfest and Schadenfreude. While one of my favorites, Leinenkugel’s Oktoberfest, was shut out (Bent River Brewery won first, second and third places at the Quad City’s annual Brew Ha Ha festival), it was a great excuse to celebrate fall on the Mississippi.

For about an hour on September 13th, David Sherman of Cohanzick Management, LLC, manager of RiverPark Short Term High Yield (RPHYX) fielded questions from Observer readers about his fund’s strategy and its risk-return profile. Somewhere between 40-50 people signed up for the RiverPark call but only about two-thirds of them signed-in. For the benefit of folks interested in hearing David’s discussion of the fund, here’s a link to an mp3 version of Thursday night’s conference call. The RiverPark folks guess it will take between 10-30 seconds to load, depending on your connection. At least on my system it loads in the same window that I’m using for my browser, so you might want to right-click and choose the “open in a new tab” option.

For about an hour on September 13th, David Sherman of Cohanzick Management, LLC, manager of RiverPark Short Term High Yield (RPHYX) fielded questions from Observer readers about his fund’s strategy and its risk-return profile. Somewhere between 40-50 people signed up for the RiverPark call but only about two-thirds of them signed-in. For the benefit of folks interested in hearing David’s discussion of the fund, here’s a link to an mp3 version of Thursday night’s conference call. The RiverPark folks guess it will take between 10-30 seconds to load, depending on your connection. At least on my system it loads in the same window that I’m using for my browser, so you might want to right-click and choose the “open in a new tab” option.