Objective and Strategy

SFGIX seeks to provide long-term capital appreciation along with some current income; it also seeks to mitigate adverse volatility in returns. The Fund invests a significant amount of its net assets in the securities of companies located in developing countries. The Fund can invest in dividend-paying common stocks, preferred stocks, convertible bonds, and fixed-income securities. The fund will invest 20-50% in developed markets and 50-80% in developing and frontier markets worldwide.

Adviser

Seafarer Capital Partners of San Francisco. Seafarer is a small, employee-owned firm whose only focus is the Seafarer fund.

Managers

Andrew Foster is the lead manager and is assisted by William Maeck. Mr. Foster is Seafarer’s founder and Chief Investment Officer. Mr. Foster formerly was manager or co-manager of Matthews Asia Growth & Income (MACSX) and Matthews’ research director and acting chief investment officer. He began his career in emerging markets in 1996, when he worked as a management consultant with A.T. Kearney, based in Singapore, then joined Matthews in 1998. Andrew was named Director of Research in 2003 and served as the firm’s Acting Chief Investment Officer during the height of the global financial crisis, from 2008 through 2009. Mr. Maeck is the associate portfolio manager and head trader for Seafarer. He’s had a long career as an investment adviser, equity analyst and management consultant. They are assisted by an analyst with deep Latin America experience.

Management’s Stake in the Fund

Mr. Foster has over $1 million in the fund. Both his associate manager and senior research analyst have substantial investments in the fund.

Opening date

February 15, 2012

Minimum investment

$2,500 for regular accounts and $1000 for retirement accounts. The minimum subsequent investment is $500.

Expense ratio

1.60% after waivers on assets of $5 million (as of June, 2012). The fund does not charge a 12(b)1 marketing fee but does have a 2% redemption fee on shares held fewer than 90 days.

Comments

The case for Seafarer is straightforward: it’s going to be one of your best options for sustaining exposure to an important but challenging asset class.

The asset class is emerging markets equities, primarily. The argument for emerging markets exposure is well-known and compelling. The emerging markets represent the single, sustainable source of earnings growth for investors. As of 2010, emerging markets represented 30% of the world’s stock market capitalization but only 6% of the average American investor’s portfolio. During the first (so-called “lost”) decade of the 21st century, the MSCI emerging markets stock index doubled in price. An analysis by Goldman projects that, over the next 20 years, the emerging markets will account for 55% of the global stock market and that China will be the world’s single largest market. That’s consistent with GMO’s May 2012 7-year asset class return forecast, which projects a 6.7% real (i.e. inflation-adjusted) annual return for emerging equities but less than 1% for the U.S. stock market as a whole. Real returns on emerging debt were projected at 1.7% while U.S. bonds were projected to lose money over the period.

Sadly, the average investor seems incapable of profiting from the potential of the emerging markets, seemingly because of our hard-wired aversion to loss. Recent studies by Morningstar and Dalbar substantiate the point. John Rekenthaler’s “Myth of the Dumb Fund Investor” (June 2012) looks at a decade’s worth of data and concludes that investors tend to pick the better fund within an asset class while simultaneously picking the worst asset classes (buying small caps just before a period of large cap outperformance). Dalbar’s Quantitative Analysis of Investor Behavior (2012) looks at 20 years of data and concluded that equity investors’ poor timing decisions cost them 2-6% annually; that is, the average equity investor trails the broad market by about that much.

The situation with emerging markets investing appears far worse. Morningstar calculates “investor returns” for many, though not all, funds. Investor returns take into account a fund’s asset size which allows Morningstar to calculate whether the average investor was around during a fund’s strongest years or its weakest. In general, investors sacrifice 65-75% of their potential returns through bad (fearful or greedy) timing. That’s based on a reading of 10-year investor versus fund returns. For T Rowe Price E. M. Stock (PRMSX), for example, the fund returned 12% annually over the last decade while the average investor earned 3%. For the large but low-rated Fidelity E.M. (FEMKX), the fund returned 10.5% while its investors made 3.5%.

Institutional investors were not noticeably more rational. JPMorgan Emerging Markets Equities Institutional (JMIEX) and Lazard Emerging Markets Equity Institutional (LZEMX) posted similar gaps. The numbers for DFA, which carefully vets and trains its clients, were wildly inconsistent: DFA Emerging Markets I (DFEMX) showed virtually no gap while DFA Emerging Markets II (DFETX) posted an enormous one. Rekenthaler also found the same weaknesses in institutional investors as he did in retail ones.

There is, however, one fund that stands in sharp contrast to this dismal general pattern: Matthews Asian Growth & Income (MACSX), which Andrew Foster co-managed or managed for eight years. Over the past decade, the fund posted entirely reasonable returns: about 11.5% per year (through June 2012). MACSX’s investors did phenomenally well. They earned, on average. 10.5% for that decade. That means they captured 91% of the fund’s gains. Over the past 15 years, the results are even better with investors capturing essentially 100% of the fund’s returns.

The great debate surrounding MACSX was whether it was the best Asia-centered fund in existence or merely one of the two or three best funds in existence. Here’s the broader truth within their disagreement: Mr. Foster’s fund was, consistently and indisputably one of the best Asian funds in existence.

The fund married an excellent strategy with excellent execution. Based on his earlier research, Mr. Foster believes that perhaps two-thirds of MACSX’s out-performance was driven by having “a more sensible” approach (for example, recognizing the strategic errors embedded in the index benchmarks which drive most “active” managers) and one-third by better security selection (driven by intensive research and over 1500 field visits). Seafarer will take the MACSX formula global. It is arguable that that Mr. Foster can create a better fund at Seafarer than he had at Matthews.

One key is geographic diversification. As of May 31, 2012, Seafarer had an 80/20 split between developing Asia and the rest of the world. Mr. Foster argues that it makes sense to hold an Asia-centered portfolio. Asia is one of the world’s most dynamic regions and legal protections for investors are steadily strengthening. It will drive the world’s economy over decades. In the shorter term, while the inevitable unraveling of the Eurozone will shake all markets, “Asia may be able to withstand such losses best.”

That said, a purely Asian portfolio is less attractive than an Asia-centered portfolio with selective exposure to other emerging markets. Other regions are, he argues, undergoing the kind of changes now than Asia underwent a generation ago which might offer the prospect of outsized returns. Some of the world’s most intriguing markets are just now becoming investable while others are becoming differently investable: while Latin America has long been a “resources play” dependent on Asian customers, it’s now developing new sectors(think “Brazilian dental HMOs”) and new markets whose value is not widely recognized. In addition, exposure to those markets will buffer the effects of a Chinese slowdown.

Currently the fund invests almost-exclusively in common stock, either directly or through ADRs and ETFs. That allocation is driven in part by fundamentals and in part by necessity. Fundamentally, emerging market valuations are “very appealing.” Mr. Foster believes that there have only been two occasions over the course of his career – during the 1997 Asian financial crisis and the 2008 global crisis – that “valuations were definitively more attractive than at present” (Shareholder Letter, 18 May 2012). That’s consistent with GMO’s projection that emerging equities will be the highest-returning asset class for the next five-to-seven years. As a matter of necessity, the fund has been too small to participate in the convertible securities market. With more assets under management, it gains the flexibility to invest in convertibles – an asset class that substantially strengthened MACSX’s performance in the past. Mr. Foster has authority to add convertibles, preferred shares and fixed income when valuations and market conditions warrant. He was done so skillfully throughout his career.

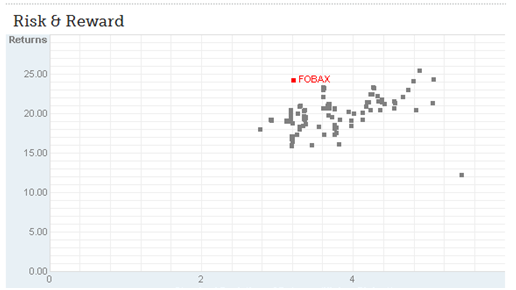

Seafarer’s returns over its first two quarters of existence (through 29 June 2012) are encouraging. Seafarer has substantially outperformed the diversified emerging markets group as a whole, iShares Asia S&P 50 (AIA) ETF, First Trust Aberdeen Emerging Opportunities fund(FEO) which is one of the strongest emerging markets balanced funds, the emerging Asia, Latin America and Europe benchmarks, an 80/20 Asia/non-Asia benchmark, and so on. It has closely followed the performance of MACSX, though it ended the period trailing by a bit.

Bottom Line

Mr. Foster is remarkably bright, thoughtful, experienced and concerned about the welfare of his shareholders. He grasps the inefficiencies built into standard emerging markets indexes, and replicated by many of the “active” funds that are benchmarked to them. He’s already navigated the vicissitudes of a region’s evolution from uninvestable to frontier, emerging and near-developed. He believes that experience will serve his shareholders “when the world’s falling apart but you see how things fit together.” He’s a good manager of risk, which has made him a great manager of returns. The fund offers him more flexibility than he’s ever had and he’s using it well. There are few more-attractive emerging markets options available.

Fund website

Seafarer Overseas Growth and Income. The website is remarkably rich, both with analyses of the fund’s portfolio and performance, and with commentary on broader issues.

Disclosure

In mid-July, about two weeks after this profile is published, I’ll purchase shares of Seafarer for my personal, non-retirement account. I’ll sell down part of my existing MACSX stake to fund that purchase.

[cr2012]