By David Snowball

Dear friends,

Welcome to what are, historically, the two most turbulent months in the market. Eight of the Dow’s 20 biggest one-day gains ever have occurred in September or October but so have 12 of the 20 biggest one-day losses.

And that might be a good thing. Some exceedingly talented investors, like Eric “I Like Volatility” Cinnamond (see below), visibly perk up at the opportunities that panic presents. And it will help distract us from the fact that, of all the things the two major political parties are about to launch (and they’re gonna launch a lot), the nicest is mud.

I wonder if this explains why the Germans have Octoberfest, but launch it in September?

Gary Black as savior? Really?

Calamos Investments announced August 23 that they had appointed Gary Black as their new “global co-CIO.” That was coincident with the departure of Nick Calamos from the co-CIO role. Mr. Calamos had a sudden urge “to pursue personal interests.”

Gary Black?

That Gary Black?

Black is most famous for serving for three years as CEO of Janus Investments. During his watch, at least 15 equity managers left Janus and one won a $7.5 million lawsuit. At the time of his dismissal (“amicable,” of course), he was reportedly trying to sell Janus to a larger firm. The board disapproved, though we don’t know whether they disapproved of selling the firm or of Black’s inability to get an appropriate price for it.

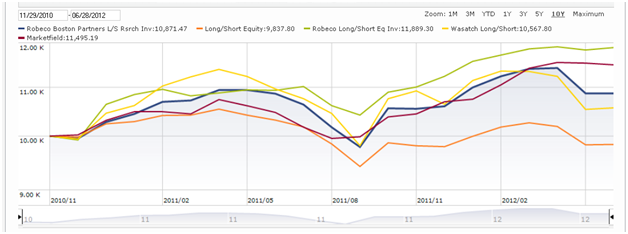

A snapshot of Janus Capital Group’s balance sheet doesn’t exactly represent a ringing endorsement of Black’s tenure.

|

Black comes (12/05) |

Black goes (12/09) |

| Revenue |

$953 million |

$849 million |

| Operating expenses |

712M |

1526M |

| Operating income |

240M |

(678)M |

| Earnings per share |

0.40 |

(4.55) |

| Long-term debt |

262 M |

792M |

| Book value per share |

$11.97 |

$5.50 |

| Assets under management |

$135 billion |

$135 billion |

(source: Morningstar and the 2009 Janus annual report)

Some might summarize it as: “huge expense, huge controversy, rising debt, falling value.”

Do you suppose, in light of all of that, that the deposed Nick Calamos’s endorsement of Black might have had a tinge of “I hope you like what you get?” He says, “The Calamos investment team is in good hands given Gary’s significant experience in leading investment teams on a global basis.”

Calamos, of course, is not hiring him as CEO. Nope. That role is held by the firm’s 72-year-old founder. They’re hiring him on the basis of his ability as chief investment officer.

How does he do as CIO? Well, a lot of his retooled Janus funds absolutely cratered in the 2008 meltdown. And his own investment firm doesn’t seem poised to appear on the cover of Barron’s quite yet. Part of the agreement includes acquisition of Black’s investment firm, Black Capital Management. Black Capital has a trivial asset base ($70 million) and a bunch of small separate accounts (average value: $370,000). Black filed in March to launch his own long-short mutual fund, but it never got off the ground.

Aston / River Road Independent Value reopens

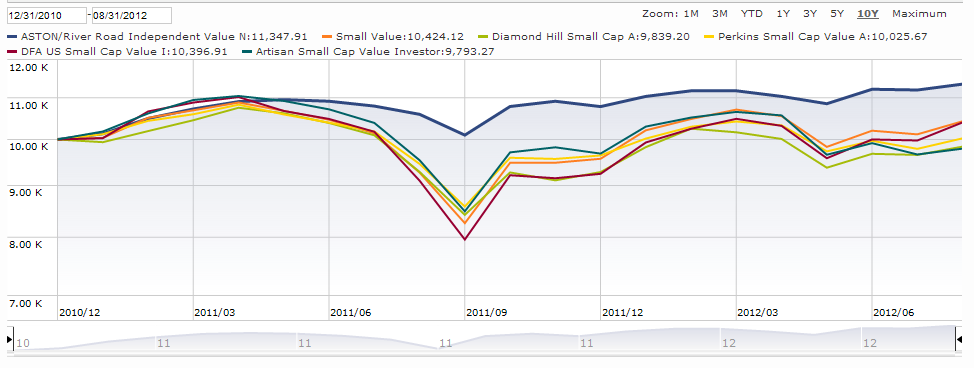

Aston/River Road Independent Value (ARIVX) is an exceptionally good young fund from Eric Cinnamond, a manager who has a great 16 year record as a small cap, absolute return investor. The fund opened in December 2010, we profiled it with some enthusiasm in February 2011. The fund quickly established its bona fides, drew a lot of assets and, in a move of singular prudence, was closed while still small and maneuverable.

Aston/River Road Independent Value (ARIVX) is an exceptionally good young fund from Eric Cinnamond, a manager who has a great 16 year record as a small cap, absolute return investor. The fund opened in December 2010, we profiled it with some enthusiasm in February 2011. The fund quickly established its bona fides, drew a lot of assets and, in a move of singular prudence, was closed while still small and maneuverable.

On September 4, it reopens to new investors. While that’s good news, it also raises a serious question: “you’re bigger than you were when you closed and you’re sitting at 50% cash, so why on earth is this time to reopen?”

Mr. Cinnamond’s answer comes in two parts. First, the fund reserved $200 million in capacity for anticipated institutional inflows which never materialized. At the same time, lots of advisors have been disappointed at getting shut off. Eric writes:

Yes, the Independent Value Fund is opening again. The rationale was simple. The $200 million we set aside for possible institutional investors was not allocated. In other words, institutional consultants (there are a few exceptions), remain committed to the relative world of investing — a world that has never made sense to me. Meanwhile, we’ve had like-minded advisors who want to purchase the Fund. So our capacity target of the Portfolio has not changed, but we have changed our expectation of mix between advisor (the fund) vs. institutional assets (separate accounts). More advisor assets and fewer institutional assets.

Second, the fund’s cash level and capacity are separate issues. Right now companies are achieving utterly unsustainable profit margins, which makes them look cheap and attractive. He shares Jeremy Grantham’s belief (or Jeremy shares Eric’s) that this is a bubble and it will inevitably (and painfully) end when profit margins regress to the mean. In a non-bubbled world, he would have use for several hundred million dollars more than the fund holds. Again, Mr. Cinnamond:

The other obvious question is, “If you have so much cash, why would you want to grow assets?” The size of the fund doesn’t impact our cash levels. Our opportunity set drives cash. If the fund is $1 million or $1 billion, cash would be the same percentage of the portfolio. We are simply reopening the fund to fill remaining capacity that was not taken by institutions.

In order to get the get the fund fully invested, I’m going to need higher volatility and improved valuations. With what appears to be an experiment in unlimited balance sheet expansion at the Federal Reserve, the timing of the return of free markets and volatility remains unknown. However, as with the mortgage credit boom and the tech bubble before, what is not sustainable will not be sustained. I am confident of that and I am confident the current profit cycle will revert as all others before it (there has never been a linear profit cycle). As peak corporate margins and profits revert, I believe the fund is position well to take advantage of the eventual return of the risk premium and volatility.

To those who suspect that he or River Road or Aston is simply making an asset grab, he notes that they are not going to market the reopened fund and that they even suspect that they may lose assets as skeptics pull their accounts.

We may actually lose assets initially due to the reopening (it may be frowned upon by some), I really don’t know and have never been too concerned about AUM. One of my favorite investment quotes of all time is “I would rather lose half of my shareholders than half of their money” (I think this was Jean-Marie Eveillard). I strongly believe in this. Also, we do not plan on actively marketing the fund and my focus will remain on small cap research/analysis and portfolio management. As far as portfolio management goes, I remain committed to not violating our investment discipline of only allocating capital when getting adequately compensated relative to risk assumed.

As he waits for those bigger opportunities, he’s reallocating money toward some attractively priced small cap exploration and production and energy service companies.

We’ve updated our profile of the fund for folks interested in learning more.

Writing about real asset investing: stuff in the ground versus stuff on the page

We’re currently working on an essay about “real asset” investing and the quickly growing pool of real asset investment vehicles. Real assets are things that have physical properties: precious metals, commodities, residential or commercial real estate, farmland, oil and gas fields, power generation plants, pipelines and other distribution systems, forestland and timber.

We’re currently working on an essay about “real asset” investing and the quickly growing pool of real asset investment vehicles. Real assets are things that have physical properties: precious metals, commodities, residential or commercial real estate, farmland, oil and gas fields, power generation plants, pipelines and other distribution systems, forestland and timber.

Advocates of real asset investing tend to justify inclusion of real assets on either (or both) of two grounds: normal and apocalyptic.

The “normal” argument observes that inflation is deadly to long-term returns, silently eroding the value of all gains. If inflation were to accelerate, that erosion might be dramatic. Neither stocks nor (especially) bonds generate real returns in periods of high and rising inflation. Real assets do.

The “apocalyptic” argument observes that we might be entering a period of increasingly unmanageable imbalances between the supply of everything from food and fertilizer to energy and metals, and the demand for them. The market’s way of addressing that imbalance is to raise the price of the items demanded. That should stimulate production and decrease consumption. Some pessimists, GMO’s Jeremy Grantham prime among them, believe that the imbalance might well be irreparable which will make the owners of resources very rich at the expense of others.

Regardless of which justification you use, you end up with inflation. Investors have the option of addressing inflation through a combination of two strategies: investing in real or tangible assets or investing in inflation-linked derivations. In the first case, you’d buy oil or the stocks of oil producing companies. In the second, you might buy TIPs or commodity index futures. The first strategy is called “real asset” investing. The second is “real return” investing.

Gaining the advantages of real asset investing requires devoting a noticeable but modest portion of your portfolio (5% at the low end and 25% at the high end) to such assets, but doing so with the knowledge that they’ll lag other investments as long as inflation stays low.

Gaining the advantages of real asset investing requires devoting a noticeable but modest portion of your portfolio (5% at the low end and 25% at the high end) to such assets, but doing so with the knowledge that they’ll lag other investments as long as inflation stays low.

While there is a huge discussion of this issue in the institutional investment community, there’s very little directed to the rest of us. There’s only one no-load real assets fund, T. Rowe Price Real Assets (PRAFX). The fund was launched for exclusive use in Price’s asset allocation products, such as their Retirement Date funds. It has only recently been made available to the public. There are a half dozen load-bearing funds, two with quite reasonable performance, one diversified real assets ETF and a thousand ETFs representing individual slices of the real asset universe.

I’d planned on profiling both real asset investing and PRAFX this month, but the research is surprisingly complex and occasionally at odds. Rather than rush to print with a second-rate essay, we’ll keep working on it for our October issue.

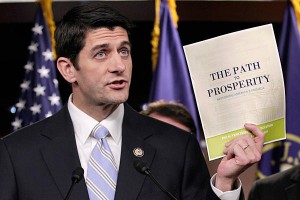

Note to Paul Ryan, Investor: Focus!

For someone professing great economic knowledge, Paul Ryan’s portfolio reflects the careful discipline of a teenager at the mall. That, at least, is one reading of his 2012 financial disclosure statements on file with the Clerk of the U.S. House of Representatives. (The statement was amended a week later to add a million or so held by his wife in a trust.)

For someone professing great economic knowledge, Paul Ryan’s portfolio reflects the careful discipline of a teenager at the mall. That, at least, is one reading of his 2012 financial disclosure statements on file with the Clerk of the U.S. House of Representatives. (The statement was amended a week later to add a million or so held by his wife in a trust.)

Highlights of his financials:

- Ryan is a real assets investor. Woo-hoo! Among his largest investments are shares of a mining partnership (Ava O Limited), gravel rights to a quarry in Oklahoma (Blondie & Brownie, LLC – I’m sure Obama’s people are sniffing around that one), IPath Dow Jones UBS Commodity fund, Nuveen Real Estate Securities, and a bunch of assets (time, mineral rights, a cabin?, and land) through the Little Land Company LP.

- In 2011, he was adding to his real asset holdings. He bought shares of a commodity ETF (and sold part four months later), Pioneer Natural Resources Co, a TIPS fund and (on three occasions) a real estate fund.

- Directly or through family trusts, Ryan owns about three dozen mutual funds, mostly solid and unexceptional (think Artisan, Fido, Hartford, T Rowe).

- He’s neither a fan of The Great Man theory of investing nor of passively managed investments. While he owns shares of Berkshire-Hathaway and PIMCO Total Return (PTTRX), the Berkshire holding is trivial ($1-15,000). The PIMCO one, mediated through two trusts, is under $50,000. Bill Gross tweeted approval (“Thanks Paul Ryan @RepPaulRyan @PaulRyanVP for investing in a PIMCO fund. Your reputation as a numbers guy is validated”), conceivably before he noticed that Ryan had been selling his shares in the fund. Other than the ETFs in his partnerships, he has no passive investments and he made 35 portfolio transactions in the year.

- He hasn’t, for reasons political or economic, bought into the notion of emerging markets. While he has several global or international funds (Artisan, Hartford, Oakmark, Scout, Vanguard), he has just one small sliver of an emerging markets ETF inside a partnership.

- He’s got a lot of economically inefficiently little investments. Footnotes to the financials reveal a fair number of holdings just above or just below the $1000 reporting threshold.

- He’s taking care of his three children’s education through two fairly substantial accounts (on in the $50-100,000 range and the other in $100-250,000) in Wisconsin’s 529 plan. That warrants a second woo-hoo.

If you’d like to find out whether your Representative should be trusted with any amount greater than a $20 weekly allowance, all of the member reports are available at the House of Representatives’ financial disclosure page.

Another take on Ryan’s finances comes in a story by Stan Luxenberg at TheStreet.com. There’s a certain irony to the fact that Luxenberg decries Ryan’s jumbled portfolio in a muddled mess of an article. Ryan owns shares of four partnerships (CMR, Little Land Co., Ryan-Hutter Investment and Ryan Limited Partnership) and an IRA. Dramatically simplifying his fund holdings would likely require merging or liquidating those partnerships. Whether the partnerships themselves make sense or are just a tax dodge is a separate question.

Artio implodes?

Artio, formerly Julius Baer, is closing their domestic equity funds. On August 30, 2012, the Artio board voted to shut down Artio US Multicap, US Midcap, US Smallcap and US Microcap funds.

While the closures may have come as a surprise to many, BobC warned members of the Observer discussion board on August 8 of the impending decision. In following up on the lead, he discovered a more ominous problem: that Artio’s famous flagship fund is taking on water fast.

This caused us to probe a bit, and we discovered that Artio’s so-called flagship international funds (BJBIX, JETAX, JETIX, JIEIX) have been bleeding assets like a proverbial stuck pig, if not worse. For the oldest fund BJBIX, which was originally marketed as Julius Baer International Equity Fund in 1993, and where current managers Pell and Younes came aboard in 1995, fund assets peaked in 2007 at just under $11 billion. We started using the fund in the late 1990’s. Today, assets are under $1 billion. A similar disaster has occurred in the other international fund ticker symbols, but they do not have the long, storied history of BJBIX. This fund was once the best-performing international fund, but it never recovered from 2008, following that year’s average numbers by really awful relative performance in 2009-2011. And year to-date it is in the bottom 10%. We exited the fund several years ago when Pell and Younes would no longer take our calls. That’s usually a pretty big red flag that something is amiss.

But based on this, it would appear that Pell and Younes’ purchase of Bank Julius Baer’s U.S. fund management company was the beginning of the end.

Unfortunately, we are now concerned about Artio’s Total Return Bond Fund (JBGIX, BJBGX), which has a tremendous history and great management. If the asset bleed should occur there, for no other reason than perception of the future of Artio as a company, this would be a big problem for investors.

A lively discussion of the company’s future, alternatives and implications followed. If you haven’t visited the board in a while, you owe it to yourself to drop by. There’s a remarkable depth of information available there.

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Aston/River Road Independent Value (ARIVX), update: stubborn short-sightedness on the part of institutional account managers translates to a big win for small investors. When ARIVX closed, they reserved $200 million in capacity for institutional investors who didn’t show up. That’s give you $200 million in room to add one of the industry’s most profitable and stable small cap value funds to your portfolio.

Northern Global Tactical Asset Allocation (BBALX), update: this formerly mild-mannered balanced fund is maturing into a fascinating competitor to Vanguard’s splendid STAR (VGSTX) fund. The difference may come down to Northern’s greater flexibility and reliance on (gasp!) index funds.

The Best of the Web

Our friend and collaborator, Junior Yearwood, is working to manage a chronic medical condition. He won’t, for just a bit, we hope, be able to contribute to the Observer. While he’s gone we’ll keep his “Best of” feature on hiatus. I wish Junior a swift recovery and encourage folks who haven’t done so to find our picks for best retirement income calculator, best financial news site, best small fund website and more at Best of the Web.

Launch Alert: Manning & Napier Strategic Income funds

Manning & Napier launched Strategic Income Conservative (MSCBX) and Strategic Income Moderate (MSMSX) on August 2, 2012. They both combine shares of four other Manning & Napier funds (Core Bond (EXCRX), Dividend Focus (MNDFX), High Yield Bond (MNHYX) and Real Estate (MNRIX) in pursuit of income, growth, and risk management. Conservative will hold 15-45% in Dividend Focus and Real Estate while Moderate will hold 45-75%. Both have low investment minimums, reasonable fees and Manning’s very steady management team.

Launch Alert: William Blair International Leaders

William Blair & Company launched William Blair International Leaders Fund (WILNX) on August 16. The fund is managed by George Greig, who has an outstanding 25 year record and two very solid funds (International Growth WBIGX and Global Growth WGGNX) and Ken McAtamney, who is being elevated from the analyst ranks. The new fund will invest in “foreign companies with above-average returns on equity, strong balance sheets, and consistent, above-average earnings growth, resulting in a focused portfolio of leading companies.” That’s an admirably Granthamite goal. $5000 investment minimum, reduced to $1000 for accounts with an automatic investing provision. The expense ratio will be 1.45% after waivers. Grieg’s record is very strong and his main fund closed to new investors in June, so we’re putting WILNX on the Observer’s watch-list for a profile.

RiverPark Short-Term High Yield conference call

There are few funds to have stirred more conversation, or engendered more misunderstanding, than RiverPark Short-Term High Yield (RPHYX). It’s a remarkably stable, profitable cash management fund whose name throws off lots of folks.

Manager David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, have generously agreed to participate in a conference call with Observer readers. I’ll moderate the call and David will field questions on the fund’s strategies and prospects. The call is September 13 at 7:00 p.m., Eastern.

You can register for the conference by navigating to http://services.choruscall.com/diamondpass/registration?confirmationNumber=10017662 and following the prompts. If you’ve got questions, feel free to write me or post a query on the discussion board.

The Observer in the News

I briefly interrupted my August vacation to answer a polite question from the investing editor of U.S. News with a rant.

The question: “what should an investor do when his or her fund manager quits?”

The rant: “in 90% of the cases, nothing.”

Why? Because, in most instances, your fund manager simply doesn’t much matter. Some very fine funds are led by management teams (Manning & Napier, Dodge & Cox) and some fund firms have such strong and intentional corporate cultures (T. Rowe Price) that new managers mostly repeat the success of their predecessors. Most funds, and most larger funds in particular, are managed with an eye to unobjectionable mediocrity. The firm’s incentive is to gather and keep assets, not to be bold. As a result, managers are expected to avoid the sorts of strategies that risk landing them outside of the pack.

There are, however, some funds where the manager makes a huge difference. Those are often smaller, newer, boutique funds where management decisions are driven by ideas more compelling than “keep our institutional clients quiet.” You can read the whole story in “What to Do When Your Fund Manager Quits,” US News, August 6, 2012.

If you’ve ever read the Observer and (understandably) wondered “who is this loon and what is he up to?” there’s a reasonable article written by a young local reporter about the Observer and me. It’s a fairly wide-ranging discussion and includes pictures that led my departmental colleagues to begin a picture captioning contest. Anya and Chip both weigh in. “Augustana professor attracts international attention with investment site,” Rock Island Argus and Moline Dispatch, August 20, 2012.

Briefly Noted . . .

SMALL WINS FOR INVESTORS

Effective September 4, 2012, The Brown Capital Management Small Company Fund (BCSIX) will re-open for investment to all investors. Morningstar designates this as one of the Gold small-growth funds. Its returns are in the top 10% of its peer group for the past 5, 10 and 15 years. It strikes me as a bit bulky at $1.4 billion but it continues to perform. Average expenses, $5000 minimum, low turnover. (Special thanks to “The Shadow” for posting to the discussion board word of the Brown and ARIVX re-openings. S/he is so quick at finding this stuff that it’s scary.)

Jake Mortell of Candlewood Advisory writes to say that “One of the funds I am working with, The Versus Capital Multimanager Real Estate Income Fund (VCMRX) is reducing fees on the first $25 million in assets into the fund as a risk offset to early adopters. The waiver reduces fees from 95 bps to 50 bps on the first $25 million in assets to the fund for a period of 12 months.” It’s a closed-end fund managed by Callan Associates, famed for the Callan Periodic Table of Investment Returns.

CLOSINGS

Invesco Van Kampen High Yield Municipal (ACTHX) will close on September 4, 2012. The fund is huge ($7 billion), good (pretty consistently in the top 25% of its peer group over longer periods) and has been closed before.

Touchstone Small Cap Core Fund (TSFAX) will close to new investments on September 21, 2012. It’s an entirely decent fund that has drawn almost $500 million in under three years.

OLD WINE, NEW BOTTLES

In November, two perfectly respectable AllianceBernstein funds get rechristened. AllianceBernstein Small/Mid Cap Growth (CHCLX) becomes AllianceBernstein Discovery Growth while AllianceBernstein Small/Mid Cap Value (ABASX) will change to AllianceBernstein Discovery Value. Same managers, same mandate, different marketing.

AllianceBernstein Balanced Shares (CABNX) becomes AllianceBernstein Global Risk Allocation on Oct. 8, 2012. New managers and a new mandate (more global allocating will go on) follow.

Artio is changing Artio Global Equity’s (BJGQX) name to Artio Select Opportunities.

BlackRock Emerging Market Debt (BEDIX) will change its name to BlackRock Emerging Market Local Debt on Sept. 3, 2012. The fund also picked up a new management team (Sergio Trigo Paz, Raphael Marechal, and Laurent Develay), all of whom are new to BlackRock. .

In mid-August, Pax World Global Green Fund became Pax World Global Environmental Markets Fund (PGRNX, “pea green”? Hmmm…). It also became almost impossible to find at Morningstar. Search “Pax World” and you find nothing. The necessary abbreviation is “Pax Wld Glbl.” While it might be a nice idea, the fund has yet to generate the returns needed to validate its focus.

I failed to mention that PineBridge US Micro Cap Growth Fund became the Jacob Micro Cap Growth Fund (JMCGX). With the same management in place, it seems likely that the fund will continue to pursue the same high expense, high risk strategy that’s handicapped it for the past decade.

WisdomTree International Hedged Equity ETF became WisdomTree Europe Hedged Equity Fund (HEDJ – “hedge,” get it?) at the end of August. The argument is that if you hedge out the effects of the collapsing euro, there are some “export-driven European-based firms that pay dividends” which are great businesses selling at compelling valuations. The valuations are compelling, in part, because so many investors are (rightly) spooked by the euro and euro-zone financial stocks. Hedge one, avoid the other, et voila!

OFF TO THE DUSTBIN OF HISTORY

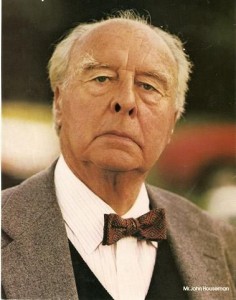

John Houseman, Smith Barney spokesperson.

Smith Barney passed away at age 75. Morgan Stanley is dropping the name from its brokerage unit in favor of Morgan Stanley Wealth Management. The Smith (1892) and Barney (1873) brokerages merged in 1938, with the resulting firm operating under a half dozen different monikers over the years. Investors of a certain age associate Smith Barney primarily with John Houseman, the actor who served as their spokesman (“They make money the old-fashioned way. They earn it”) in the late 1970s and 1980s. The change is effective this month.

SmartMoney, the magazine, is no more. Originally (1992) a joint venture between Hearst and Dow-Jones, Dow bought Heart’s take in the magazine in 2010. The final print issue, September 2012, went on newsstands on August 14. In one of those fine bits of bloodless corporate rhetoric, Dow-Jones admitted that “[a]pproximately 25 staff positions for the print edition are being impacted.” “Impacted.” Uh… eliminated. Subscribers have the option of picking up The Wall Street Journal or, in my case, Barron’s.

American Independence is liquidating its Nestegg series of target-date funds. The five funds will close at the end of August and cease operations at the end of September 2012. They’re the fourth firm (after Columbia, Goldman Sachs and Oppenheimer) to abandon the niche this summer.

BMO plans to liquidate BMO Large-Cap Focus (MLIFX).

In what surely qualifies as a “small win” for investors, Direxion is liquidating its nine triple-leveraged ETFs (for example, Direxion Daily BRIC Bear 3X Shares BRIS) by mid-September.

Dreyfus plans to merge Dreyfus/Standish Fixed Income (SDFIX) into Dreyfus Intermediate-Term Income (DRITX) in January 2013. Same manager on both.

DWS Clean Technology (WRMAX) is liquidating in September 2012.

FocusShares announced plans to close and liquidate its entire lineup of 15 exchange-traded funds, all of which have minimal asset levels. The Scottrade subsidiary, which launched its ETFs last year, cited current market conditions, the funds’ inability to draw assets and their future viability, as well as prospects for growth in the ETFs’ assets, for the closing.

Guggenheim Long Short Equity (RYJJX) and Guggenheim All Cap Value (SESAX) are both slated for liquidation. Apparently the Long-Short managers screwed up:

Due to unfavorable market conditions, the Long Short Equity Strategy Fund (the “Fund”) has assumed a defensive investment position in an effort to protect the current value of the Fund. While the Fund is invested in this manner, it does not invest in accordance with certain of its investment policies, including its investment policy to invest, under normal circumstances, at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities, and/or derivatives thereof.

With no assets, terrible returns and a portfolio turnover rate approaching 1000%, one hardly needed additional reasons to close the fund. All Cap Value is going just because it was tiny and bad.

Jones Villalta Opportunity Fund (JVOFX), managed by Messrs Jones and Villalta, is being liquidated on September 21. The fund had a great 2009 and a really good 2010, followed by miserable performance in 2011 and 2012. It never gained any market traction and the management finally gave up.

Marsico Emerging Markets (MERGX) will be liquidated on September 21, 2012. The fund, less than two years old, had a rotten 2011 and a mediocre 2012. One of its two managers, Joshua Rubin, resigned in July. Frankly, the larger factor might be that Marsico is in crisis and they simply couldn’t afford to deal with this dud in the midst of their other struggles. Star managers Doug Rao and Cory Gilchrist have both left in the past 12 months, leaving an awfully thin bench.

Nuveen Large Cap Value (FASKX) will likely merge into Nuveen Dividend Value (FFEIX) in October 2012. Nuveen Large Cap Value’s assets have dwindled to less than $140 million after several years of steady outflows. The move also makes sense as both funds are run by the same management team. Owners of Nuveen Large Cap Value should expect to see fees drop by 5 basis points as a result of the merger.

The Profit Opportunity (PROFX) fund has closed and will be liquidated by the end of September. It was minuscule (around $300,000), young (under two years) and inexplicably bad. PROFX is a small cap fund run by Eugene Profit, whose other small cap fund (Profit PVALX) is small but entirely first-rate. Odd disconnect.

Russell Investments is shutting down all 25 of its passively managed funds, with a combined total of over $310 million. The one ETF that will remain in operation is the Russell Equity ETF (ONEF) with $4.2 million in AUM. The shutdown will take place over the middle two weeks of October.

About the same time, Russell U.S. Value Fund (RSVIX) is merging in Russell U.S. Defensive Equity Fund (REQAX). They’re both closet index funds (R-squared of about 99) with mediocre records. The key difference is that REQAX is a large and reasonably profitable mediocre, closet-index fund. RSVIX was not.

Sterling Capital Management has filed to liquidate the Sterling Capital National Tax-Free Money Market, Sterling Capital Prime Money Market Fund, and Sterling Capital U.S. Treasury Money Market Fund. The funds will be liquidated on December 14, 2012.

Touchstone Intermediate Fixed Income (TCFIX) has been liquidated after poor performance led to the departure of a major shareholder.

In Closing . . .

Each month we highlight changes in the fund world that you might not otherwise notice. This month we’ve found a near-record 69 fund manager changes. In addition, there are 10 new funds in registration with the SEC. They are not yet available for sale but knowing about them (say, for example, Wasatch’s new focused Emerging Markets fund) might help your planning. Most will come on the market by Thanksgiving.

In about a week the discussion board is undergoing a major software upgrade. Chip and Accipiter have built some cool new functions into the latest version of Vanilla. Chip highlights these:

- There’s an add-on that will let folks more easily format their posts: a hyperlink function (much requested) and easy images are part of it;

- A polling add-on that will allow us to quickly survey members;

- Enhancements to the administration of the discussion board;

- Pop up alerts, that you can choose to enable or disable, to notify you when certain content is updated or posts are responded to; and most importantly

- We’ll be able to take advantage of some of cool add-ons that Accipiter’s been working over the past months.

We might be offline for a couple hours, but we’ll post a notice of the exact time well in advance.

I’m often amazed at what goes on over there, by the way. There have been over 2.5 million pageviews and 3300 discussions launched. That’s made possible by a combination of the wit and generosity of the posters and the amazing work that Chip and Accipiter have done in programming and reprogramming the board to make it ever more responsive to folks’ needs (and now to Old Joe’s willingness to turn his considerable talents as a technical writer to the production of a User’s Guide for newcomers). Quiet thanks to you all.

Following from the enthusiasm of the folks on our discussion board, we’re scheduled to profile T. Rowe Price Real Assets PRAFX (waves to Polina! It’s sort of a “meh” fund but is looking like our best no-load option), Artisan Global Equity ARTHX (“hey, Investor. I’ve been putting this one off because I was starting to feel like a shill for Artisan. They’ve earned the respect, but still …”) and the Whitebox funds (subject of a Barron’s profile and three separate discussion threads. Following our conversation with David Sherman at Cohanzick, we have an update of RiverPark Short Term High Yield (RPHYX) in the works and owe one for the splendid, rapidly growing RiverPark Wedgewood Growth (RPGFX) fund.

The following announcement is brought to you by Investor, a senior member of the Observer’s discussion community:

And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s link to Amazon.com. It’s quick, painless and generates the revenue (equal to about 6% of the value of your purchases) that helps keep the Observer going.

My theory is that if I keep busy enough, I won’t notice either the daily insanity of the market or what happens next to the Steelers’ increasingly fragile O-line.

We’ll look for you then,

Aston/River Road Independent Value (ARIVX) is an exceptionally good young fund from Eric Cinnamond, a manager who has a great 16 year record as a small cap, absolute return investor. The fund opened in December 2010, we profiled it with some enthusiasm in February 2011. The fund quickly established its bona fides, drew a lot of assets and, in a move of singular prudence, was closed while still small and maneuverable.

Aston/River Road Independent Value (ARIVX) is an exceptionally good young fund from Eric Cinnamond, a manager who has a great 16 year record as a small cap, absolute return investor. The fund opened in December 2010, we profiled it with some enthusiasm in February 2011. The fund quickly established its bona fides, drew a lot of assets and, in a move of singular prudence, was closed while still small and maneuverable.

For someone professing great economic knowledge, Paul Ryan’s portfolio reflects the careful discipline of a teenager at the mall. That, at least, is one reading of his

For someone professing great economic knowledge, Paul Ryan’s portfolio reflects the careful discipline of a teenager at the mall. That, at least, is one reading of his

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (

I’ll be the first to admit it: I have a face made for radio and a voice made for print. Nonetheless, I was pleased to make an appearance on Chuck Jaffe’s MoneyLife radio show (

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors.

The folks at the Observer visit scores of fund company websites each month and it’s hard to avoid the recognition that most of them are pretty mediocre. The worst of them post as little content as possible, updated as rarely as possible, signaling the manager’s complete disdain for the needs and concerns of his (and very rarely, her) investors. This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites.

This month, Junior and I enlisted the aid of two immensely talented web designers to help us analyze three dozen small fund websites in order to find and explain the best of them. One expert is Anya Zolotusky, designer of the Observer’s site and likely star of a series of “Most Interesting Woman in the World” sangria commercials. The other is Nina Eisenman, president of Eisenman Associates and founder of FundSites, a firm which helps small to mid-sized fund companies design distinctive and effective websites. And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s

And speaking of fall, it’s back-to-school shopping time! If you’re planning to do some or all of your b-t-s shopping online, please remember to Use the Observer’s