Dear friends,

I know that for lots of you, this is the season of Big Questions:

- Is the Fed’s insistence on destroying the incentive to save (my credit union savings account is paying 0.05%) creating a disastrous incentive to move “safe” resources into risky asset classes?

- Has the recent passion for high quality, dividend-paying stocks already consumed most of their likely gains for the next decade?

- Should you Sell in May and Go Away?

- Perhaps, Stay for June and Endure the Swoon?

My set of questions is a bit different:

- Why haven’t those danged green beans sprouted yet? It’s been a week.

- How should we handle the pitching rotation on my son’s Little League team? We’ve got four games in the span of five days (two had been rained out and one was hailed out) and just three boys – Will included! – who can find the plate.

- If I put off returning my Propaganda students’ papers one more day, what’s the prospect that I’ll end up strung up like Mussolini?

Which is to say, summer is creeping upon us. Enjoy the season and life while you can!

Of Acorns and Oaks

It’s human nature to make sense out of things. Whether it’s imposing patterns on the stars in the sky (Hey look! It’s a crab!) or generating rules of thumb for predicting stock market performances (It’s all about the first five days of the day), we’re relentless in insisting that there’s pattern and predictability to our world.

One of the patterns that I’ve either discerning or invented is this: the alumni of Oakmark International seem to have startlingly consistent success as portfolio managers. The Oakmark International team is led by David Herro, Oakmark’s CIO for international equities and manager of Oakmark International (OAKIX) since 1992. Among the folks whose Oakmark ties are most visible:

|

|

Current assignment |

Since |

Snapshot |

|

David Herro |

Oakmark International (OAKIX), Oakmark International Small Cap (OAKEX) |

09/1992 |

Five stars for 3, 5, 10 and overall for OAKIX; International Fund Manager of the Decade |

|

Dan O’Keefe and David Samra |

Artisan International Value (ARTKX), Artisan Global Value (ARTGX) |

09/2002 and 12/2007 |

International Fund Manager of the Year nominees, two five star funds |

|

Abhay Deshpande |

First Eagle Overseas A (SGOVX) |

Joined First Eagle in 2000, became co-manager in 09/2007 |

Longest-serving members of the management team on this five-star fund |

|

Chad Clark |

Select Equity Group, a private investment firm in New York City |

06/2009 |

“extraordinarily successful” at “quality value” investing for the rich |

|

Pierre Py (and, originally, Eric Bokota) |

FPA International Value (FPIVX) |

12/2011 |

Top 2% in their first full year, despite a 30% cash stake |

|

Greg Jackson |

Oakseed Opportunity (SEEDX) |

12/2012 |

A really solid start entirely masked by the events of a single day |

|

Robert Sanborn |

|

|

|

|

Ralph Wanger |

Acorn Fund |

|

|

|

Joe Mansueto |

Morningstar |

|

Wonderfully creative in identifying stock themes |

The Oakmark alumni certainly extend far beyond this list and far back in time. Ralph Wanger, the brilliant and eccentric Imperial Squirrel who launched the Acorn Fund (ACRNX) and Wanger Asset Management started at Harris Associates. So, too, did Morningstar founder Joe Mansueto. Wanger frequently joked that if he’d only hired Mansueto when he had the chance, he would not have been haunted by questions for “stylebox purity” over the rest of his career. The original manager of Oakmark Fund (OAKMX) was Robert Sanborn, who got seriously out of step with the market for a bit and left to help found Sanborn Kilcollin Partners. He spent some fair amount of time thereafter comparing how Oakmark would have done if Bill Nygren had simply held Sanborn’s final portfolio, rather than replacing it.

In recent times, the attention centers on alumni of the international side of Oakmark’s operation, which is almost entirely divorced from its domestic investment operation. It’s “not just on a different floor, but almost on a different world,” one alumnus suggested. And so I set out to answer the questions: are they really that consistently excellent? And, if so, why?

The answers are satisfyingly unclear. Are they really consistently excellent? Maybe. Pierre Py made a couple interesting notes. One is that there’s a fair amount of turnover in Herro’s analyst team and we only notice the alumni who go on to bigger and better things. The other note is that when you’ve been recognized as the International Fund Manager of the Decade and you can offer your analysts essentially unlimited resources and access, it’s remarkably easy to attract some of the brightest and most ambitious young minds in the business.

What, other than native brilliance, might explain their subsequent success? Dan O’Keefe argues that Herro has been successful in creating a powerful culture that teaches people to think like investors and not just like analysts. Analysts worry about finding the best opportunities within their assigned industry; investors need to examine the universe of all of the opportunities available, then decide how much money – if any – to commit to any of them. “If you’re an auto industry analyst, there’s always a car company that you think deserves attention,” one said. Herro’s team is comprised of generalists rather than industry specialists, so that they’re forced to look more broadly. Mr. Py compared it to the mindset of a consultant: they learn to ask the big, broad questions about industry-wide practices and challenges, rising and declining competitors, and alternatives. But Herro’s special genius, Pierre suggested, was in teaching young colleagues how to interview a management team; that is, how to get inside their heads, understand the quality of their thinking and anticipate their strengths and mistakes. “There’s an art to it that can make your investment process much better.” (As a guy with a doctorate in communication studies and a quarter century in competitive debate, I concur.)

The question for me is, if it works, why is it rare? Why is it that other teams don’t replicate Herro’s method? Or, for that matter, why don’t they replicate Artisan Partner’s structure – which is designed to be (and has been) attractive to the brightest managers and to guard (as it has) against creeping corporatism and groupthink? It’s a question that goes far beyond the organization of mutual funds and might even creep toward the question, why are so many of us so anxious to be safely mediocre?

Three Messages from Rob Arnott

Robert D. Arnott manages PIMCO’s All Asset (PAAIX) and leveraged All Asset All Authority (PAUIX) funds. Morningstar gives each fund five stars for performance relative to moderate and world allocation peers, in addition to gold and silver analyst ratings, respectively, for process, performance, people, parent and price. On PAAIX’s performance during the 2008 financial crises, Mr. Arnott explains: “I was horrified when we ended the year down 15%.” Then, he learned his funds were among the very top performers for the calendar year, where average allocation funds lost nearly twice that amount. PAUIX, which uses modest leverage and short strategies making it a bit more market neutral, lost only 6%.

Of 30 or so lead portfolio managers responsible for 110 open-end funds and ETFs at PIMCO, only William H. Gross has a longer current tenure than Mr. Arnott. The All Asset Fund was launched in 2002, the same year Mr. Arnott founded Research Affiliates, LLC (RA), a firm that specializes in innovative indexing and asset allocation strategies. Today, RA estimates $142B is managed worldwide using its strategies, and RA is the only sub-advisor that PIMCO, which manages over $2T, credits on its website.

On April 15th, CFA Society of Los Angeles hosted Mr. Arnott at the Montecito Country Club for a lunch-time talk, entitled “Real Return Investing.” About 40 people attended comprising advisors, academics, and PIMCO staff. The setting was elegant but casual, inside a California mission-style building with dark wooden floors, white stucco walls, and panoramic views of Santa Barbara’s coast. The speaker wore one of his signature purple-print ties. After his very frank and open talk, which he prefaced by stating that the research he would be presenting is “just facts…so don’t shoot the messenger,” he graciously answered every question asked.

Three takeaways: 1) fundamental indexing beats cap-weighed indexing, 2) investors should include vehicles other than core equities and bonds to help achieve attractive returns, and 3) US economy is headed for a 3-D hurricane of deficit, debt, and demographics. Here’s a closer look at each message:

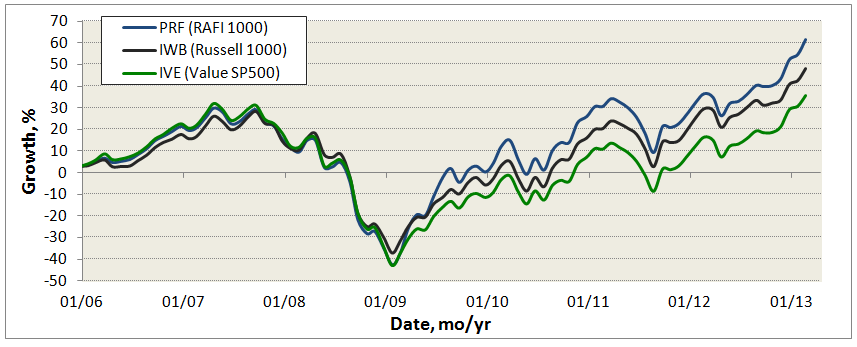

Fundamental Indexation is the title of Mr. Arnott’s 2005 paper with Jason Hsu and Philip Moore. It argues that capital allocated to stocks based on weights of price-insensitive fundamentals, such as book value, dividends, cash flow, and sales, outperforms cap-weighted SP500 by an average of 2% a year with similar volatilities. The following chart compares Power Shares FTSE RAFI US 1000 ETF (symbol: PRF), which is based on RA Fundamental Index (RAFI) of the Russell 1000 companies, with ETFs IWB and IVE:

And here are the attendant risk-adjusted numbers, all over same time period:

RAFI wins, delivering higher absolute and risk-adjusted returns. Are the higher returns a consequence of holding higher risk? That debate continues. “We remain agnostic as to the true driver of the Fundamental indexes’ excess return over the cap-weighted indexes; we simply recognize that they outperformed significantly and with some consistency across diverse market and economic environments.” A series of RAFIs exist today for many markets and they consistently beat their cap-weighed analogs.

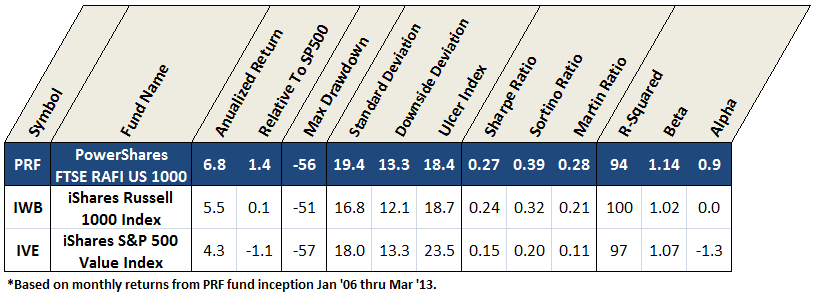

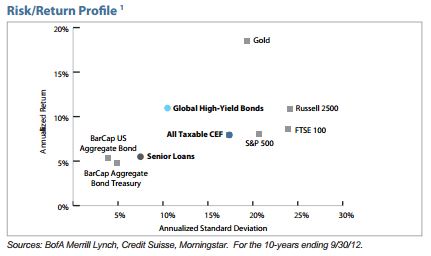

All Assets include commodity futures, emerging market local currency bonds, bank loans, TIPS, high yield bonds, and REITs, which typically enjoy minimal representation in conventional portfolios. “A cult of equities,” Mr. Arnott challenges, “no matter what the price?” He then presents research showing that while the last decade may have been lost on core equities and bonds, an equally weighted, more broadly diversified, 16-asset class portfolio yielded 7.3% annualized for the 12 years ending December 2012 versus 3.8% per year for the traditional 60/40 strategy. The non-traditional classes, which RA coins “the third pillar,” help investors “diversify away some of the mainstream stock and bond concentration risk, introduce a source of real returns in event of prospective inflation from monetizing debt, and seek higher yields and/or rates of growth in other markets.”

Mr. Arnott believes that “chasing past returns is likely the biggest mistake investors make.” He illustrates with periodic returns such as those depicted below, where best performing asset classes (blue) often flip in the next period, becoming worst performers (red)…and rarely if ever repeat.

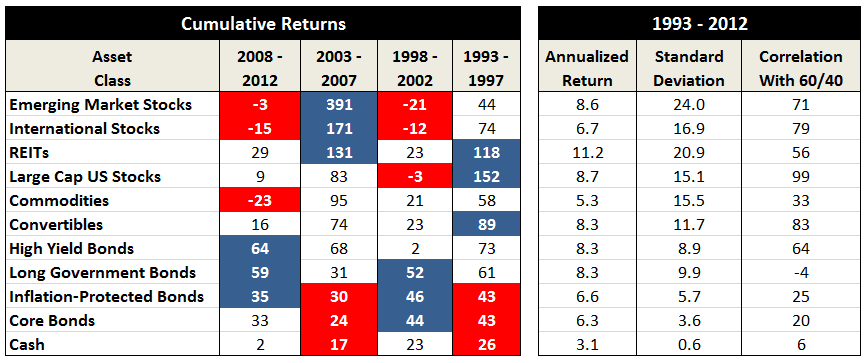

Better instead to be allocated across all assets, but tactically adjust weightings based on a contrarian value-oriented process, assessing current valuation against opportunity for future growth…seeking assets out of favor, priced for better returns. PAAIX and PAUIX (each a fund of funds utilizing the PIMCO family) employ this approach. Here are their performance numbers, along with comparison against some competitors, all over same period:

The All Asset funds have performed very well against many notable allocation funds, like OAKBX and VWENX, protecting against drawdowns while delivering healthy returns, as evidenced by high Martin ratios. But static asset allocator PRPFX has actually delivered higher absolute and risk-adjusted returns. This outperformance is likely attributed its gold holding, which has detracted very recently. On gold, Mr. Arnott states: “When you need gold, you need gold…not GLD.” Newer competitors also employing all-asset strategies are ABRYX and AQRIX. Both have returned handsomely, but neither has yet weathered a 2008-like drawdown environment.

The 3-D Hurricane Force Headwind is caused by waves of deficit spending, which artificially props-up GDP, higher than published debt, and aging demographics. RA has published data showing debt-to-GDP is closer to 500% or even higher rather than 100% value oft-cited, after including state and local debt, Government Sponsored Enterprises (e.g., Fannie Mae, Freddie Mac), and unfunded entitlements. It warns that deficit spending may feel good now, but payback time will be difficult.

“Last year, the retired population grew faster than the population of working age adults, yet there was no mention in the press.” Mr. Arnott predicts this transition will manifest in a smaller labor force and lower productivity. It’s inevitable that Americans will need to “save more, spend less, and retire later.” By 2020, the baby boomers will be outnumbered 2:1 by votes, implying any “solemn vows” regarding future entitlements will be at risk. Many developed countries have similar challenges.

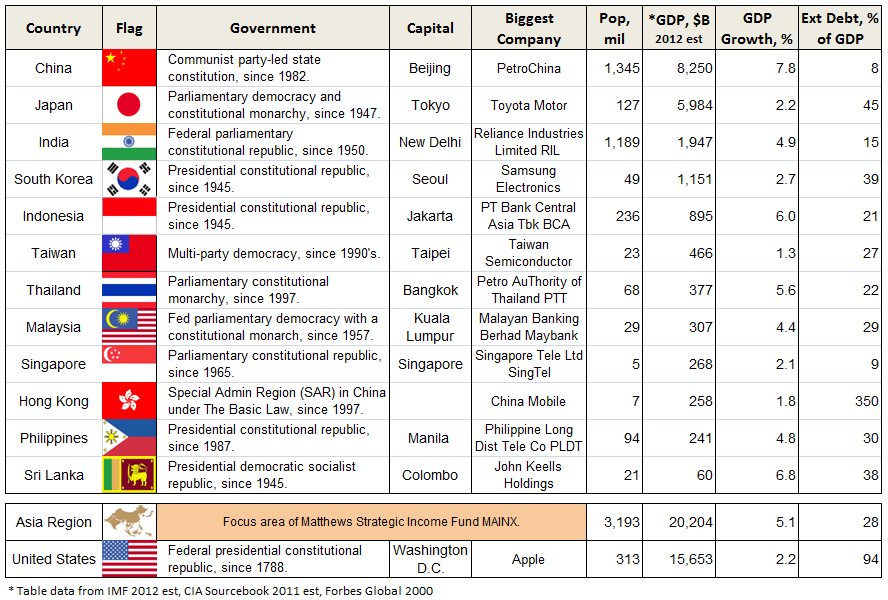

Expectations going forward? Instead of 7.6% return for the 60/40 portfolio, expect 4.5%, as evidenced by low bond and dividend yields. To do better, Mr. Arnott advises investing away from the 3-D hurricane toward emerging economies that have stable political systems, younger populations, and lower debt…where fastest GDP growth occurs. Plus, add in RAFI and all asset exposure.

Are they at least greasy high-yield bonds?

One of the things I most dislike about ETFs – in addition to the fact that 95% of them are wildly inappropriate for the portfolio of any investor who has a time horizon beyond this afternoon – is the callous willingness of their boards to transmute the funds. The story is this: some marketing visionary decides that the time is right for a fund targeting, oh, corporations involved in private space flight ventures and launches an ETF on the (invented) sector. Eight months later they notice that no one’s interested so, rather than being patient, tweaking, liquidating or merging the fund, they simply hijack the existing vehicle and create a new, entirely-unrelated fund.

Here’s news for the five or six people who actually invested in the Sustainable North American Oil Sands ETF (SNDS): you’re about to become shareholders in the YieldShares High Income ETF. The deal goes through on June 21. Do you have any say in the matter? Nope. Why not? Because for the Sustainable North American Oil Sands fund, investing in oil sands companies was legally a non-fundamental policy so there was no need to check with shareholders before changing it.

The change is a cost-saving shortcut for the fund sponsors. An even better shortcut would be to avoid launching the sort of micro-focused funds (did you really think there was going to be huge investor interest in livestock or sugar – both the object of two separate exchange-traded products?) that end up festooning Ron Rowland’s ETF Deathwatch list.

Introducing the Owl

Over the past month chip and I have been working with a remarkably talented graphic designer and friend, Barb Bradac, to upgrade our visual identity. Barb’s first task was to create our first-ever logo, and it debuts this month.

Cool, eh?

We started by thinking about the Observer’s mission and ethos, and how best to capture that visually. The apparent dignity, quiet watchfulness and unexpected ferocity of the Great Horned Owl – they’re sometimes called “tigers with wings” and are quite willing to strike prey three times their own size – was immediately appealing. Barb’s genius is in identifying the essence of an image, and stripping away everything else. She admits, “I don’t know what to say about the wise old owl, except he lends himself soooo well to minimalist geometric treatment just naturally, doesn’t he? I wanted to trim off everything not essential, and he still looks like an owl.”

We started by thinking about the Observer’s mission and ethos, and how best to capture that visually. The apparent dignity, quiet watchfulness and unexpected ferocity of the Great Horned Owl – they’re sometimes called “tigers with wings” and are quite willing to strike prey three times their own size – was immediately appealing. Barb’s genius is in identifying the essence of an image, and stripping away everything else. She admits, “I don’t know what to say about the wise old owl, except he lends himself soooo well to minimalist geometric treatment just naturally, doesn’t he? I wanted to trim off everything not essential, and he still looks like an owl.”

At first, we’ll use our owl in our print materials (business cards, thank-you notes, that sort of thing) and in the article reprints that funds occasionally commission. For those interested, the folks at Cook and Bynum asked for a reprint of Charles’s excellent “Inoculated by Value” essay and our new graphic identity debuted there. With time we’ll work with Barb and Anya to incorporate the owl – who really needs a name – into our online presence as well.

The Observer resources that you’ve likely missed!

Each time we add a new resource, we try to highlight it for folks. Since our readership has grown so dramatically in the past year – about 11,000 folks drop by each month – a lot of folks weren’t here for those announcements. As a public service, I’d like to highlight three resources worth your time.

The Navigator is a custom-built mutual fund research tool, accessible under the Resources tab. If you know the name of a fund, or part of the name or its ticker, enter it into The Navigator. It will auto-complete the fund’s name, identify its ticker symbols and immediately links you to reports or stories on that fund or ETF on 20 other sites (Yahoo Finance, MaxFunds, Morningstar). If you’re sensibly using the Observer’s resources as a starting point for your own due diligence research, The Navigator gives you quick access to a host of free, public resources to allow you to pursue that goal.

Featured Funds is an outgrowth of our series of monthly conference calls. We set up calls – free and accessible to all – with managers who strike us as being really interesting and successful. This is not a “buy list” or anything like it. It’s a collection of funds whose managers have convinced me that they’re a lot more interesting and thoughtful than their peers. Our plan with these calls is to give every interested reader to chance to hear what I hear and to ask their own questions. After we talk with a manager, the inestimably talented Chip creates a Featured Fund page that draws together all of the resources we can offer you on the fund. That includes an mp3 of the conference call and my take on the call’s highlights, an updated profile of the fund and also a thousand word audio profile of the fund (presented by a very talented British friend, Emma Presley), direct links to the fund’s own resources and a shortcut to The Navigator’s output on the funds.

There are, so far, seven Featured Funds:

- ASTON/RiverRoad Long/Short (ARLSX)

- Cook and Bynum (COBYX)

- Matthews Asia Strategic Income (MAINX)

- RiverPark Long/Short Opportunity (RLSFX)

- RiverPark Short-Term High Yield (RPHYX)

- RiverPark/Wedgewood (RWGFX)

- Seafarer Overseas Growth and Income (SFGIX)

Manager Change Search Engine is a feature created by Accipiter, our lead programmer, primarily for use by our discussion board members. Each month Chip and I scan hundreds of Form 497 filings at the SEC and other online reports to track down as many manager changes as we can. Those are posted each month (they’re under the “Funds” tab) and arranged alphabetically by fund name. Accipiter’s search engine allows you to enter the name of a fund company (Fidelity) and see all of the manager changes we have on record for them. To access the search engine, you need to go to the discussion board and click on the MGR tab at top. (I know it’s a little inconvenient, but the program was written as a plug-in for the Vanilla software that underlies the discussion board. It will be a while before Accipiter is available to rewrite the program for us, so you’ll just have to be brave for a bit.)

Valley Forge Fund staggers about

For most folks, Valley Forge Fund (VAFGX) is understandably invisible. It was iconic mostly because it so adamantly rejected the trappings of a normal fund. It was run since the Nixon Administration by Bernard Klawans, a retired aerospace engineer. He tended to own just a handful of stocks and cash. For about 20 years he beat the market then for the next 20 he trailed it. In the aftermath of the late 90s mania, he went back to modestly beating the market. He didn’t waste money on marketing or even an 800-number and when someone talked him into having a website, it remained pretty much one page long.

Mr. Klawans passed away on December 22, 2011, at the age of 90. Craig T. Aronhalt who had co-managed the fund since the beginning of 2009 died on November 3, 2012 of cancer. Morningstar seems not to have noticed his death: six months after passing away, they continue listing him as manager. It’s not at all clear who is actually running the thing though, frankly, for a fund that’s 25% in cash it’s having an entirely respectable year with a gain of nearly 10% through the end of April.

The more-curious development is the Board’s notice, entitled “Important information about the Fund’s Lack of Investment Adviser”

For the period beginning April 1, 2013 through the date the Fund’s shareholders approve a new investment advisory agreement (estimated to be achieved by May 17, 2013), the Fund will not be managed by an investment adviser or a portfolio manager (the “Interim Period”). During the Interim Period, the Fund’s portfolio is expected to remain largely unchanged, subject to the ability of the Board of Directors of the Fund to, as it deems appropriate under the circumstances, make such portfolio changes as are consistent with the Fund’s prospectus. During the Interim Period, the Fund will not be subject to any advisory fees.

Because none of the members of Fund’s Board of Directors has any experience as portfolio managers, management risk will be heightened during the Interim Period, and you may lose money.

How does that work? The manager died at the beginning of November but the board doesn’t notice until April 1? If someone was running the portfolio since November, the law requires disclosure of that fact. I know that Mr. Buffett has threatened to run Berkshire Hathaway for six months after his death, so perhaps … ?

If that is the explanation, it could be a real cost-savings strategy since health care and retirement benefits for the deceased should be pretty minimal.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds.

FPA International Value (FPIVX): It’s not surprising that manager Pierre Py is an absolute return investor. That is, after all, the bedrock of FPA’s investment culture. What is surprising is that it has also be an excellent relative return vehicle: despite a substantial cash reserve and aversion to the market’s high valuations, it has also substantially outperformed its fully-invested peers since inception.

Oakseed Opportunity Fund (SEEDX): Finally! Good news for all those investors disheartened by the fact that the asset-gatherers have taken over the fund industry. Jackson Park has your back.

“Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

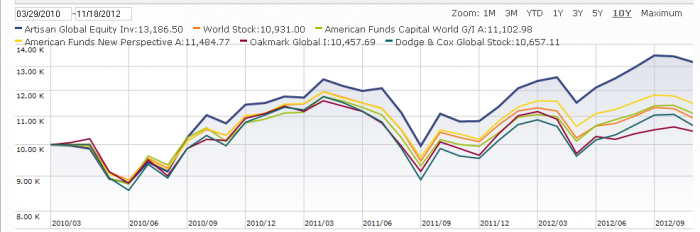

Artisan Global Value Fund (ARTGX): I keep looking for sensible caveats to share with you about this fund. Messrs. Samra and O’Keefe keep making my concerns look silly, so I think I might give up and admit that they’re remarkable.

Payden Global Low Duration Fund (PYGSX): Short-term bond funds make a lot of sense as a conservative slice of your portfolio, most especially during the long bull market in US bonds. The question is: what happens when the bull market here stalls out? One good answer is: look for a fund that’s equally adept at investing “there” as well as “here.” Over 17 years of operation, PYGSX has made a good case that they are that fund.

Elevator Talk #4: Jim Hillary, LS Opportunity Fund (LSOFX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

M r. Hillary manages Independence Capital Asset Partners (ICAP), a long/short equity hedge fund he launched on November 1, 2004 that serves as the sub-advisor to the LS Opportunity Fund (LSOFX), which in turn launched on September 29, 2010. Prior to embarking on a hedge fund career, Mr. Hillary was a co-founder and director of research for Marsico Capital Management where he managed the Marsico 21st Century Fund (MXXIX) until February 2003 and co-managed all large cap products with Tom Marsico. In addition to his US hedge fund and LSOFX in the mutual fund space, ICAP runs a UCITS for European investors. Jim offers these 200 words on why his mutual fund could be right for you:

r. Hillary manages Independence Capital Asset Partners (ICAP), a long/short equity hedge fund he launched on November 1, 2004 that serves as the sub-advisor to the LS Opportunity Fund (LSOFX), which in turn launched on September 29, 2010. Prior to embarking on a hedge fund career, Mr. Hillary was a co-founder and director of research for Marsico Capital Management where he managed the Marsico 21st Century Fund (MXXIX) until February 2003 and co-managed all large cap products with Tom Marsico. In addition to his US hedge fund and LSOFX in the mutual fund space, ICAP runs a UCITS for European investors. Jim offers these 200 words on why his mutual fund could be right for you:

In 2004, I believed that after 20 years of above average equity returns we would experience a period of below average returns. Since 2004, the equity market has been characterized by lower returns and heightened volatility, and given the structural imbalances in the world and the generationally low interest rates I expect this to continue. Within such an environment, a long/short strategy provides exposure to the equity market with a degree of protection not provided by “long-only” funds.

In 2010, we agreed to offer investors the ICAP investment process in a mutual fund format through LSOFX. Our process aims to identify investment opportunities not limited to style or market capitalization. The quality of research on Wall Street continues to decline and investors are becoming increasingly concerned about short-term performance. Our in-depth research and long-term orientation in our high conviction ideas provide us with a considerable advantage. It is often during times of stress that ICAP uncovers unusual investment opportunities. A contrarian approach with a longer-term view is our method of generating value-added returns. If an investor is searching for a vehicle to diversify away from long-only, balanced or fixed income products, a hedge fund strategy like ours might be helpful.

The fund has a single share class with no load and no 12b-1 fees. The minimum initial investment is $5,000 and net expenses are capped at 1.95%. More information about the Advisor and Sub-Advisor can be found on the fund’s website, www.longshortadvisors.com. Jim’s most recent commentary can be found in the fund’s November 2012 Semi-Annual Report.

RiverPark/Wedgewood Fund: Conference Call Highlights

I had a chance to speak with David Rolfe of Wedgewood Partners and Morty Schaja, president of RiverPark Funds. A couple dozen listeners joined us, though most remained shy and quiet. Morty opened the call by noting the distinctiveness of RWGFX’s performance profile: even given a couple quarters of low relative returns, it substantially leads its peers since inception. Most folks would expect a very concentrated fund to lead in up markets. It does, beating peers by about 10%. Few would expect it to lead in down markets, but it does: it’s about 15% better in down markets than are its peers. Mr. Schaja is invested in the fund and planned on adding to his holdings in the week following the call.

I had a chance to speak with David Rolfe of Wedgewood Partners and Morty Schaja, president of RiverPark Funds. A couple dozen listeners joined us, though most remained shy and quiet. Morty opened the call by noting the distinctiveness of RWGFX’s performance profile: even given a couple quarters of low relative returns, it substantially leads its peers since inception. Most folks would expect a very concentrated fund to lead in up markets. It does, beating peers by about 10%. Few would expect it to lead in down markets, but it does: it’s about 15% better in down markets than are its peers. Mr. Schaja is invested in the fund and planned on adding to his holdings in the week following the call.

The strategy: Rolfe invests in 20 or so high-quality, high-growth firms. He has another 15-20 on his watchlist, a combination of great mid-caps that are a bit too small to invest in and great large caps a bit too pricey to invest in. It’s a fairly low turnover strategy and his predilection is to let his winners run. He’s deeply skeptical of the condition of the market as a whole – he sees badly stretched valuations and a sort of mania for high-dividend stocks – but he neither invests in the market as a whole nor are his investment decisions driven by the state of the market. He’s sensitive to the state of individual stocks in the portfolio; he’s sold down four or five holdings in the last several months nut has only added four or five in the past two years. Rather than putting the proceeds of the sales into cash, he’s sort of rebalancing the portfolio by adding to the best-valued stocks he already owns.

His argument for Apple: For what interest it holds, that’s Apple. He argues that analysts are assigning irrationally low values to Apple, somewhere between those appropriate to a firm that will never see real topline growth again and one that which see a permanent decline in its sales. He argues that Apple has been able to construct a customer ecosystem that makes it likely that the purchase of one iProduct to lead to the purchase of others. Once you’ve got an iPod, you get an iTunes account and an iTunes library which makes it unlikely that you’ll switch to another brand of mp3 player and which increases the chance that you’ll pick up an iPhone or iPad which seamlessly integrates the experiences you’ve already built up. As of the call, Apple was selling at $400. Their sum-of-the-parts valuation is somewhere in the $600-650 range.

On the question of expenses: Finally, the strategy capacity is north of $10 billion and he’s currently managing about $4 billion in this strategy (between the fund and private accounts). With a 20 stock portfolio, that implies a $500 million in each stock when he’s at full capacity. The expense ratio is 1.25% and is not likely to decrease much, according to Mr. Schaja. He says that the fund’s operations were subsidized until about six months ago and are just in the black now. He suggested that there might be, at most, 20 or so basis points of flexibility in the expenses. I’m not sure where to come down on the expense issue. No other managed, concentrated retail fund is substantially cheaper – Baron Partners and Edgewood Growth are 15-20 basis points more, Oakmark Select and CGM Focus are 15-20 basis points less while a bunch of BlackRock funds charge almost the same.

Bottom Line: On whole, it strikes me as a remarkable strategy: simple, high return, low excitement, repeatable and sustained for near a quarter century.

For folks interested but unable to join us, here’s the complete audio of the hour-long conversation.

When you click on the link, the file will load in your browser and will begin playing after it’s partially loaded. If the file downloads, instead, you may have to double-click to play it.

Conference Call Upcoming: Bretton Fund (BRTNX), May 28, 7:00 – 8:00 Eastern

Manager Steve Dodson, former president of the Parnassus Funds, is an experienced investment professional, pursuing a simple discipline. He wants to buy deeply discounted stocks, but not a lot of them. Where some funds tout a “best ideas” focus and then own dozens of the same large cap stocks, Mr. Dodson seems to mean it when he says “just my best.”

Manager Steve Dodson, former president of the Parnassus Funds, is an experienced investment professional, pursuing a simple discipline. He wants to buy deeply discounted stocks, but not a lot of them. Where some funds tout a “best ideas” focus and then own dozens of the same large cap stocks, Mr. Dodson seems to mean it when he says “just my best.”

As of 12/30/12, the fund held just 16 stocks. Nearly as much is invested in microcaps as in megacaps. In addition to being agnostic about size, the fund is also unconstrained by style or sector. Half of the fund’s holdings are characterized as “growth” stocks, half are not. The fund offers no exposure at all in seven of Morningstar’s 11 industry sectors, but is over weighted by 4:1 in financials.

In another of those “don’t judge it against the performance of groups to which it doesn’t belong” admonitions, it has been assigned to Morningstar’s midcap blend peer group though it owns only one midcap stock.

Our conference call will be Tuesday, May 28, from 7:00 – 8:00 Eastern.

How can you join in? Just click

Members of our standing Conference Call Notification List will receive a reminder, notes from the manager and a registration link around the 20th of May. If you’d like to join about 150 of your peers in receiving a monthly notice (registration and the call are both free), feel free to drop me a note.

Launch Alert: ASTON/LMCG Emerging Markets (ALEMX)

This is Aston’s latest attempt to give the public – or at least “the mass affluent” – access to managers who normally employ distinctive strategies on behalf of high net worth individuals and institutions. LMCG is the Lee Munder Capital Group (no, not the Munder of Munder NetNet and Munder Nothing-but-Net fame – that’s Munder Capital Management, a different group). Over the five years ended December 30, 2012, the composite performance of LMCG’s emerging markets separate accounts was 2.8% while their average peer lost 0.9%. In 2012, a good year for emerging markets overall, LMCG made 24% – about 50% better than their average peer. The fund’s three managers, Gordon Johnson, Shannon Ericson and Vikram Srimurthy, all joined LMCG in 2006 after a stint at Evergreen Asset Management. The minimum initial investment in the retail share class is $2500, reduced to $500 for IRAs. The opening expense ratio will be 1.65% (with Aston absorbing an additional 4.7% of expenses). The fund’s homepage is cleanly organized and contains links to a few supporting documents.

This is Aston’s latest attempt to give the public – or at least “the mass affluent” – access to managers who normally employ distinctive strategies on behalf of high net worth individuals and institutions. LMCG is the Lee Munder Capital Group (no, not the Munder of Munder NetNet and Munder Nothing-but-Net fame – that’s Munder Capital Management, a different group). Over the five years ended December 30, 2012, the composite performance of LMCG’s emerging markets separate accounts was 2.8% while their average peer lost 0.9%. In 2012, a good year for emerging markets overall, LMCG made 24% – about 50% better than their average peer. The fund’s three managers, Gordon Johnson, Shannon Ericson and Vikram Srimurthy, all joined LMCG in 2006 after a stint at Evergreen Asset Management. The minimum initial investment in the retail share class is $2500, reduced to $500 for IRAs. The opening expense ratio will be 1.65% (with Aston absorbing an additional 4.7% of expenses). The fund’s homepage is cleanly organized and contains links to a few supporting documents.

Launch Alert II: Matthews Asia Focus and Matthews Emerging Asia

On May 1, Matthews Asia launched two new funds. Matthews Asia Focus Fund (MAFSX and MIFSX) will invest in 25 to 35 mid- to large-cap stocks. By way of contrast, their Asian Growth and Income fund has 50 stocks and Asia Growth has 55. The manager wants to invest in high-quality companies and believes that they are emerging in Asia. “Asia now [offers] a growing pool of established companies with good corporate governance, strong management teams, medium to long operating histories and that are recognized as global or regional leaders in their industry.” The fund is managed by Kenneth Lowe, who has been co-managing Matthews Asian Growth and Income (MACSX) since 2011. The opening expense ratio, after waivers, is 1.91%. The minimum initial investment is $2500, reduced to $500 for an IRA.

Matthews Emerging Asia Fund (MEASX and MIASX) invests primarily in companies located in the emerging and frontier Asia equity markets, such as Bangladesh, Cambodia, Indonesia, Malaysia, Myanmar, Pakistan, Philippines, Sri Lanka, Thailand and Vietnam. It will be an all-cap portfolio with 60 to 100 names. The fund will be managed by Taizo Ishida, who also manages managing the Asia Growth (MPACX) and Japan (MJFOX) funds. The opening expense ratio, after waivers, is 2.16%. The minimum initial investment is $2500, reduced to $500 for an IRA.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details. Every day we scour new SEC filings to see what opportunities might be about to present themselves. Many of the proposed funds offer nothing new, distinctive or interesting. Some are downright horrors of Dilbertesque babble (see “Synthetic Reverse Convertibles,” below).

Funds in registration this month won’t be available for sale until, typically, the beginning of July 2013. We found fifteen no-load, retail funds (and Gary Black) in the pipeline, notably:

AQR Long-Short Equity Fund will seek capital appreciation through a global long/short portfolio, focusing on the developed world. “The Fund seeks to provide investors with three different sources of return: 1) the potential gains from its long-short equity positions, 2) overall exposure to equity markets, and 3) the tactical variation of its net exposure to equity markets.” They’re targeting a beta of 0.5. The fund will be managed by Jacques A. Friedman, Lars Nielsen and Andrea Frazzini (Ph.D!), who all co-manage other AQR funds. Expenses are not yet set. The minimum initial investment for “N” Class shares is $1,000,000 but several AQR funds have been available through fund supermarkets for a $2500 investment. AQR deserves thoughtful attention, but their record across all of their funds is more mixed than you might realize. Risk Parity has been a fine fund while others range from pretty average to surprisingly weak.

RiverPark Structural Alpha Fund will seek long-term capital appreciation while exposing investors to less risk than broad stock market indices. Because they believe that “options on market indices are generally overpriced,” their strategy will center on “selling index equity options [which] will structurally generate superior returns . . . [with] less volatility, more stable returns, and reduce[d] downside risk.” This portfolio was a hedge fund run by Wavecrest Asset Management. That fund launched on September 29, 2008 and will continue to operate under it transforms into the mutual fund, on June 30, 2013. The fund made a profit in 2008 and returned an average of 10.7% annually through the end of 2012. Over that same period, the S&P500 returned 6.2% with substantially greater volatility. The Wavecrest management team, Justin Frankel and Jeremy Berman, has now joined RiverPark – which has done a really nice job of finding talent – and will continue to manage the fund. The opening expense ratio with be 2.0% after waivers and the minimum initial investment is $1000.

Curiously, over half of the funds filed for registration on the same day. Details on these funds and the list of all of the funds in registration are available at the Observer’s Funds in Registration page or by clicking “Funds” on the menu atop each page.

Manager Changes

On a related note, we also tracked down 37 fund manager changes. Those include Oakmark’s belated realization that they needed at least three guys to replace the inimitable Ed Studzinski on Oakmark Equity and Income (OAKBX), and a cascade of changes triggered by the departure of one of the many guys named Perkins at Perkins Investment Management.

Briefly Noted . . .

Seafarer visits Paris: Seafarer has been selected to manage a SICAV, Essor Asie (ESSRASI). A SICAV (“sea cav” for the monolingual among us, Société d’Investissement À Capital Variable for the polyglot) is the European equivalent of an open-end mutual fund. Michele Foster reports that “It is sponsored by Martin Maurel Gestion, the fund advisory division of a French bank, Banque Martin Maurel. Essor translates to roughly arising or emerging, and Asie is Asia.” The fund, which launched in 1997, invests in Asia ex-Japan and can invest in both debt and equity. Given both Mr. Foster’s skill and his schooling at INSEAD, it seems like a natural fit.

Out of exuberance over our new graphic design, we’ve poured our Seafarer Overseas Growth and Income (SFGIX) profile into our new reprint design template. Please do let us know how we could tweak it to make it more visually effective and functional.

Nile spans the globe: Effective May 1, 2013, Nile Africa Fixed Income Fund became Nile Africa and Frontier Bond Fund. The change allows the fund to add bonds from any frontier-market on the planet to its portfolio.

Nationwide is absorbing 17 HighMark Mutual Funds: The changeover will take place some time in the third quarter of 2013. This includes most of the Highmark family and the plan is for the current sub-advisers to be retained. Two HighMark funds, Tactical Growth & Income Allocation and Tactical Capital Growth, didn’t make the cut and are scheduled for liquidation.

USAA is planning to launch active ETFs: USAA has submitted paperwork with the SEC seeking permission to create 14 actively managed exchange-traded funds, mostly mimicking already-existing USAA mutual funds.

Small Wins for Investors

On or before June 30, 2013, Artio International Equity, International Equity II and Select Opportunities funds will be given over to Aberdeen’s Global Equity team, which is based in Edinburgh, Scotland. The decline of the Artio operation has been absolutely stunning and it was more than time for a change. Artio Total Return Bond Fund and Artio Global High Income Fund will continue to be managed by their current portfolio teams.

ATAC Inflation Rotation Fund (ATACX) has reduced the minimum initial investment for its Investor Class Shares from $25,000 to $2,500 for regular accounts and from $10,000 to $2,500 for IRA accounts.

Longleaf Partners Global Fund (LLGLX) reopened to new investment on April 16, 2013. I was baffled by its closing – it discovered, three weeks after launch, that there was nothing worth buying – and am a bit baffled by its opening, which occurred after the unattractive market had risen by another 3%.

Vanguard announced on April 3 that it is reopening the $9 billion Vanguard Capital Opportunity Fund (VHCOX) to individual investors and removing the $25,000 annual limit on additional purchases. The fund has seen substantial outflows over the past three years. In response, the board decided to make it available to individual investors while leaving it closed to all financial advisory and institutional clients, other than those who invest through a Vanguard brokerage account. This is a pretty striking opportunity. The fund is run by PRIMECAP Management, which has done a remarkable job over time.

Closings

DuPont Capital Emerging Markets Fund (DCMEX) initiated a “soft close” on April 30, 2013.

Effective June 30, 2013, the FMI Large Cap (FMIHX) Fund will be closed to new investors.

Eighteen months after launching the Grandeur Peak Funds, Grandeur Peak Global Advisors announced that it will soft close both the Grandeur Peak Global Opportunities Fund (GPGOX) and the Grandeur Peak International Opportunities (GPIOX) Fund on May 1, 2013.

After May 17, 2013 the SouthernSun Small Cap Fund (SSSFX) will be closed to new investors. The fund has pretty consistently generated returns 50% greater than those of its peers. The same manager, Michael Cook, also runs the smaller, newer, midcap-focused SouthernSun US Equity Fund (SSEFX). The latter fund’s average market cap is low enough to suggest that it holds recent alumni of the small cap fund. I’ll note that we profiled all four of those soon-to-be-closed funds when they were small, excellent and unknown.

Touchstone Merger Arbitrage Fund (TMGAX) closed to new accounts on April 8, 2013. The fund raised a half billion in under two years and substantially outperformed its peers, so the closing is somewhere between “no surprise” and “reassuring.”

Old Wine, New Bottles

In one of those “what the huh?” announcements, the Board of Trustees of the Catalyst Large Cap Value Fund (LVXAX) voted “to change in the name of the Fund to the Catalyst Insider Buying Fund.” Uhh … there already is a Catalyst Insider Buying Fund (INSAX).

Lazard U.S. High Yield Portfolio (LZHOX) is on its way to becoming Lazard U.S. Corporate Income Portfolio, effective June 28, 2013. It will invest in bonds issued by corporations “and non-governmental issuers similar to corporations.” They hope to focus on “better quality” (their term) junk bonds.

Off to the Dustbin of History

Dreyfus Small Cap Equity Fund (DSEAX) will transfer all of its assets in a tax-free reorganization to Dreyfus/The Boston Company Small Cap Value Fund (STSVX).

Around June 21, 2013, Fidelity Large Cap Growth Fund (FSLGX) will disappear into Fidelity Stock Selector All Cap Fund (FDSSX). This is an enormously annoying move and an illustration of why one might avoid Fidelity. FSLGX’s great flaw is that it has attracted only $170 million; FDSSX’s great virtue is that it has attracted over $3 billion. FDSSX is an analyst-run fund with over 1100 stocks, 11 named managers and a track record inferior to FSLGX (which has one manager and 134 stocks).

Legg Mason Capital Management All Cap Fund (SPAAX) will be absorbed by ClearBridge Large Cap Value Fund (SINAX). The Clearbridge fund is cheaper and better, so that’s a win of sorts.

In Closing …

If you haven’t already done so, please do consider bookmarking our Amazon link. It generates a pretty consistent $500/month for us but I have to admit to a certain degree of trepidation over the imminent (and entirely sensible) change in law which will require online retailers with over a $1 million in sales to collect state sales tax. I don’t know if the change will decrease Amazon’s attractiveness or if it might cause Amazon to limit compensation to the Associates program, but it could.

As always, the Amazon and PayPal links are just … uhh, over there —>

That’s all for now, folks!

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

We’ve saved the most curious, and most disappointing, for last. American Funds has always been a sort of benevolent behemoth. They’re old (1931) and massive. They manage more than $900 billion in investments and over 50 million shareholder accounts, with $300 billion in non-U.S. assets.

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in:

Mr. Kerr manages the Rocky Peak Small Cap Value Fund (RPCSX), which launched on April 2, 2012. He co-managed RCB’s Small Cap Value strategy and the CNI Charter RCB Small Cap Value Fund (formerly RCBAX, now CSCSX) fund. Tom offers these 200 words on why folks should check in: There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.

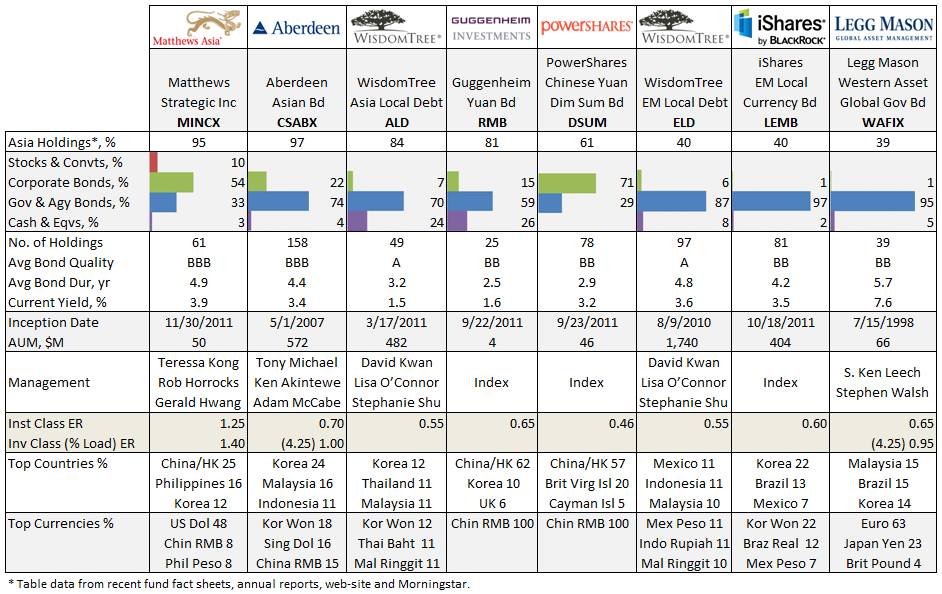

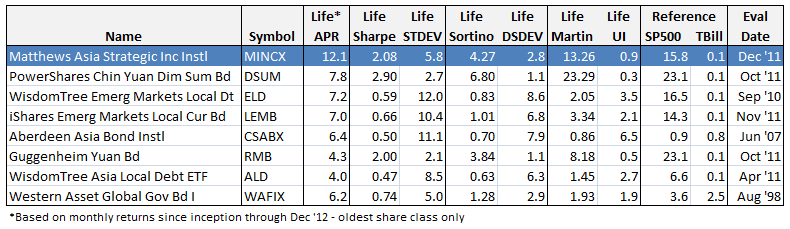

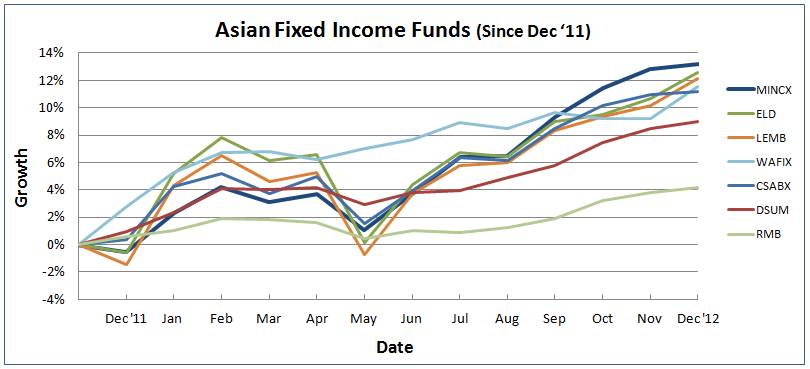

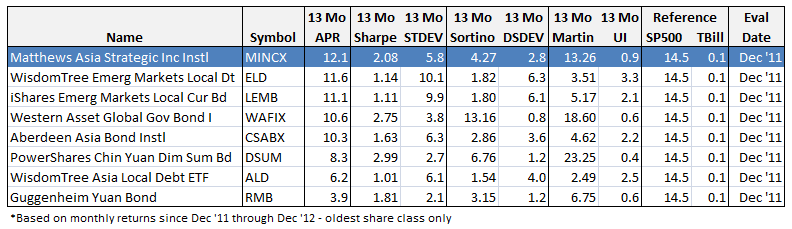

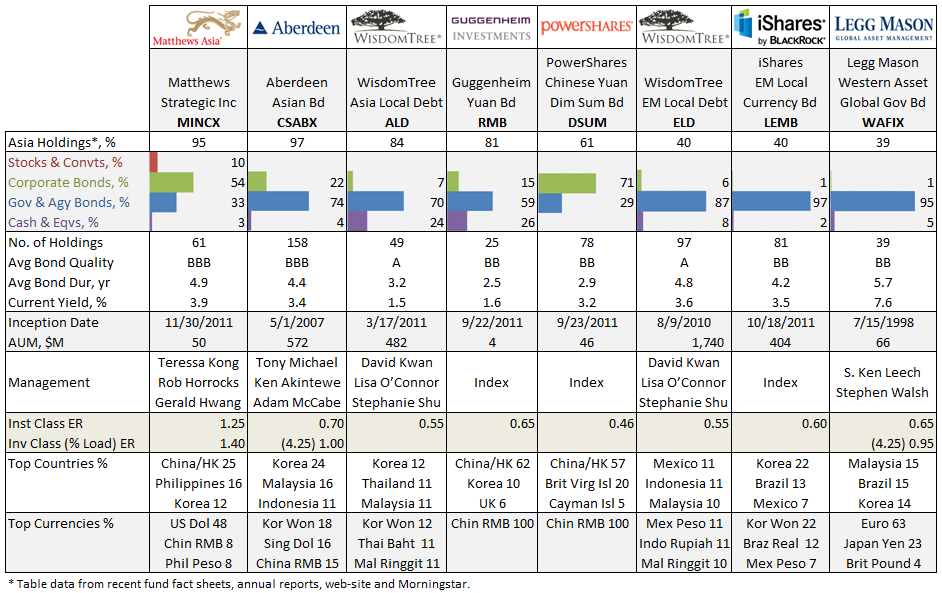

There are, in addition, 123 beached whales: funds with more than a billion in assets that have trailed their peer groups for the past three, five and ten years. Of those, 29 earn ratings in the Bronze to Gold range, 31 are Neutral and just six warrant Negative ratings. So, being large and consistently bad makes you five times more likely to earn a positive rating than a negative one.  We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

We spent an hour on Tuesday, January 22, talking with Teresa Kong of Matthews Asia Strategic Income. The fund is about 14 months old, has about $40 million in assets, returned 13.6% in 2012 and 11.95% since launch (through Dec. 31, 2012).

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story: A couple months ago we profiled

A couple months ago we profiled  Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On

Our March conference call will occur unusually early in the month, so I wanted to give you advance word of it now. On

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade.

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade. FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights:

FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights: I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note.

I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note. Our next conference call features Teresa Kong, manager of

Our next conference call features Teresa Kong, manager of

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

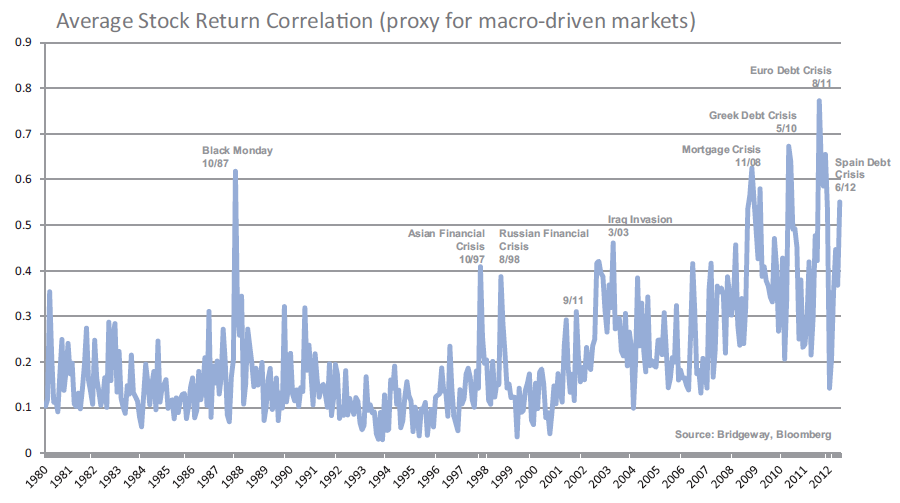

Volatility is tremendously exciting for many investment managers. You’d be amazed by the number who get up every morning, hoping for a market panic. For the rest of us, it’s simply terrifying.

Volatility is tremendously exciting for many investment managers. You’d be amazed by the number who get up every morning, hoping for a market panic. For the rest of us, it’s simply terrifying. Our next conference call features Matt Moran and Dan Johnson, co-managers of

Our next conference call features Matt Moran and Dan Johnson, co-managers of  We’re hoping to start 2013 with a conversation with Andrew Foster of

We’re hoping to start 2013 with a conversation with Andrew Foster of

On November 1, Whitebox Advisors converted their Whitebox Long Short Equity Partners hedge fund into the Whitebox Long Short Equity Fund which has three share classes. As a hedge fund, Whitebox pretty much kicked butt. From 2004 – 2012, it returned 15.8% annually while the S&P500 earned 5.2%. At last report, the fund was just slightly net-long with a major short against the Russell 2000.

On November 1, Whitebox Advisors converted their Whitebox Long Short Equity Partners hedge fund into the Whitebox Long Short Equity Fund which has three share classes. As a hedge fund, Whitebox pretty much kicked butt. From 2004 – 2012, it returned 15.8% annually while the S&P500 earned 5.2%. At last report, the fund was just slightly net-long with a major short against the Russell 2000.

The Observer is trying to help two distinct but complementary groups of folks. One group are investors who are trying to get past all the noise and hype. (CNBC’s ratings are dropping like a rock, which should help.) We’re hoping, in particular, to help folks examine evidence or possibilities that they wouldn’t normally see. The other group are the managers and other folks associated with small funds and fund boutiques. We believe in you. We believe that, as the industry evolves, too much emphasis falls on asset-gathering and on funds launched just for the sake of dangling something new and shiny (uhh … the All Cap Insider Sentiment ETF). We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. And so we profile them, write about them and talk with other folks in the media about them.

The Observer is trying to help two distinct but complementary groups of folks. One group are investors who are trying to get past all the noise and hype. (CNBC’s ratings are dropping like a rock, which should help.) We’re hoping, in particular, to help folks examine evidence or possibilities that they wouldn’t normally see. The other group are the managers and other folks associated with small funds and fund boutiques. We believe in you. We believe that, as the industry evolves, too much emphasis falls on asset-gathering and on funds launched just for the sake of dangling something new and shiny (uhh … the All Cap Insider Sentiment ETF). We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. And so we profile them, write about them and talk with other folks in the media about them.

The best book there is on the subject of practical persuasion is Robert Cialdini’s

The best book there is on the subject of practical persuasion is Robert Cialdini’s